- Total revenue collected through stamp duty and registration fees in Mumbai in Feb. 2023 is over INR 1,102 Cr while back in February 2022 it was approx. INR 615 Cr

- In contrast, total no. of property registrations dropped by 8% in a yr. – from 10,379 registrations in Feb. 2022 to nearly 9,511 registrations in Feb. 2023

- Feb. 2023 has seen highest revenue collection in the city in last five years during same month & in entire FY 2023

- Meanwhile, luxury housing performed remarkably well in 2022 – total sales share in top 7 cities went up to 18% of 3.65 lakh units sold against just 7% of over 2.61 lakh units sold back in 2019

- In terms of overall sales share, MMR’s luxury housing sales share increased from 13% in 2019 to nearly 30% in 2022

- HNIs across cities rushing to close luxury housing deal before FY 2023 ends, possibly due to govt.’s recent cap on capital gains at INR 10 Crore which shall be implemented from April 2023

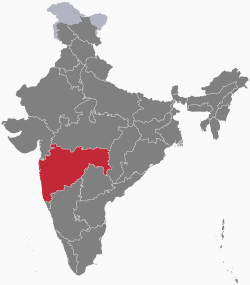

The bull run in Indian luxury housing continues even while property prices are on the rise. As per Inspector General of Registration (IGR), Maharashtra, India’s most expensive city – Mumbai – saw revenue collections from property registrations touch new high in February 2023 at INR 1,102 Cr. This was a whopping 79% jump against February 2022 collections when it stood at INR 615 Cr.

Anuj Puri, Chairman- ANAROCK Group, says, “Interestingly, even while revenue collections went up significantly in the period in Mumbai, the total number of property registrations saw a drop of 8% in the year – from 10,379 total registrations in February 2022 to nearly 9,511 registrations in February 2023. This clearly indicates that the sale of big-ticket price homes (i.e. luxury homes) saw significant movement.”

If we deep-dive into data further, February 2023 has seen the highest revenue collection in Mumbai in the last five years during the same month. Also, in entire FY 2023, we saw February to record the maximum revenue collections.

One major factor for high sales of big-ticket price homes in Mumbai and other top cities could be the government’s recent move in the Union Budget 2023-24 to cap capital gains at INR 10 Cr. This new move will come into effect from April 2023. Thus, to save tax on capital gains, the HNIs across top cities including Mumbai are rushing in close luxury housing deals before the financial year ends in March.

Under this new move, if one sells a house/other assets including equities and his/her gains are more than INR 10 crore, then maximum benefit that can be availed is only up to INR 10 crore when invested into another property. Capital gains of over INR 10 Cr will henceforth be taxed from April 2023.

Previously, to save on tax from their capital gains, HNIs/ultra-HNIs would mostly re-invest into an ultra-luxury property. Thus, the new move could be a deterrent for luxury housing sales to an extent once the new provision comes into effect. However, to say that it will have a major impact on this segment will remain to be seen.

Luxury Sales Share Up at 18% across Top 7 Cities

The luxury housing segment has performed remarkably well post the pandemic, with overall sales rising steeply across the top 7 cities. Year 2022 has been even better. As per ANAROCK Research, out of the total 3.65 lakh units sold across the top 7 cities in 2022, about 18% (approx. 65,680 units) were in the luxury category priced >INR 1.5 Cr.

Contrastingly, of the total 2.61 lakh units sold in entire 2019, just 7% (approx. 17,740 units) were in the luxury category.

MMR, NCR and Hyderabad have led luxury homes sales in 2022 with approx. 50,100 units sold in these three cities altogether. Back in 2019, together they saw sales of mere 14,050 luxury homes in the entire year.

- Data further reveals that in terms of overall sales share, MMR’s luxury housing sales share increased from 13% (of 80,870 units) in 2019 to nearly 30% (of approx. 1.10 lakh units) in 2022.

- In NCR, the sales share rose to 15% (of approx. 63,710 units) in 2022, from 4% (of total 46,920 units sold) in 2019.

- In Hyderabad, it increased to 16% (of total 47,490 units sold) in 2022 from 10% of 16,590 units sold in 2019.

| Luxury Housing Sales Share across Top 7 Cities | |||||||||

| Year | 2019 | 2020 | 2021 | 2022 | |||||

| Total Unit Sales across all budget categories | 2,61,360 | 1,38,350 | 2,36,520 | 3,64,870 | |||||

| % Sales Share of Luxury Homes (>INR 1.5 Cr.) | 7% | 6% | 9% | 18% |

Also Read: Mumbai generates Rs 1k Crore Stamp Duty in Feb, a first in FY 22-23