India retail witnesses remarkable growth in 2023, led by quality real estate supply and consumer resurgence

- Indian retail expects a supply pipeline of over 38 mn sq ft of retail developments between H2 2023 and 2027

- 3.16 mn sq ft of gross leasing in top 7 cities in H1 2023

- Existing retail stock across the top 7 cities offers a potential of ~43-44 mn sq ft of REIT-worthy retail assets.

Post a strong comeback in 2022, the growth momentum of India’s retail sector continues to stay strong in 2023. The Indian retail sector is taking a leap forward by growing sales and revenue and is also witnessing unprecedented transformation through the introduction of newer formats, increasing institutional investment, and entry of new global brands.

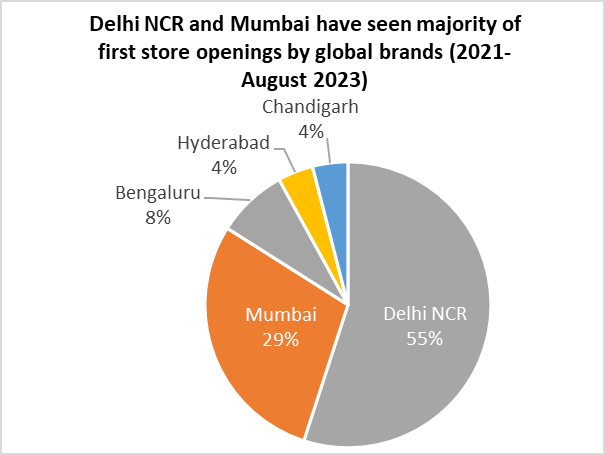

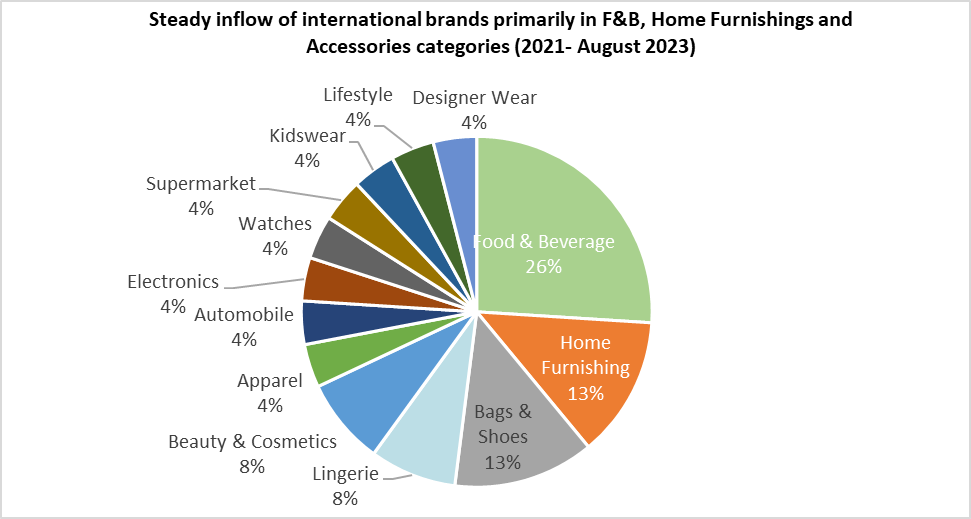

JLL India’s latest report titled India Retail: Evolving to a new dawn, states that India continues to be a preferred market for international brands. Increased consumption, rising institutional participation, strategic partnerships of Indian retail chains, and a supportive regulatory environment are making India a lucrative destination for global brands. 24 New International brands have entered India since 2021, making a beeline for superior-quality mall developments in the gateway cities of Delhi NCR, Mumbai, and Bengaluru. Nearly a quarter of these new entrants were in the F&B category.

The report finds that while omnichannel retail is increasingly becoming important, physical stores still play a vital role in providing experiential shopping and social connect experiences to consumers. The operational retail stock as of H1 2023 in the top seven cities(Delhi NCR, Mumbai, Pune, Bengaluru, Kolkata, Chennai, and Hyderabad) stands at 89 million sq ft. More than 50% of the current operational mall stock lies in Delhi NCR (28 million sq ft) and Mumbai (17 million sq ft). Mall completions of around 1.1 million sq ft were recorded in H1 2023, with additions in Hyderabad and Delhi NCR.

| Operational Stock as of H1 2023 (of shopping malls across top 7 cities of India) 89 mn sqft | Supply pipeline (H2 2023-2027) 38.04 mn sqft | Gross Leasing (H1 2023) (across top seven cities of India in shopping malls and leading high streets 3.16 mn sqft | Entry of 24 new international brands since 2021 |

“India’s retail sector is on an elevated growth curve where the focus is on creating an innovative built environment, greater connections with the consumers, and curating physical storefronts in untapped regions of the country including tier II and III cities. The shopping mall stock which stands at 89 million sq ft as of H1 2023 is expected to increase by around 43% to reach 127 million sq ft by the end of 2027. With India’s first retail REIT launched recently, the developers will focus on upgrading their retail assets by churning tenant mix, incorporating entertainment, leisure, and F&B avenues. Investments into new-age technology and improved user interfaces to appeal to a more tech-savvy, millennial generation are also being undertaken as part of a refreshed brand experience.” said Rahul Arora, Head of Office Leasing Advisory and Retail Services, India, JLL.

Gross leasing across the top seven cities (in shopping malls and leading high streets) stood at 3.16 million sq ft in H1 2023, indicative of consumer confidence translating into expansion by retailers. Bengaluru led with a 34% share followed by Delhi NCR (23%) and Hyderabad (19%). Fashion & Apparel and F&B brands have dominated the H1 leasing activity.

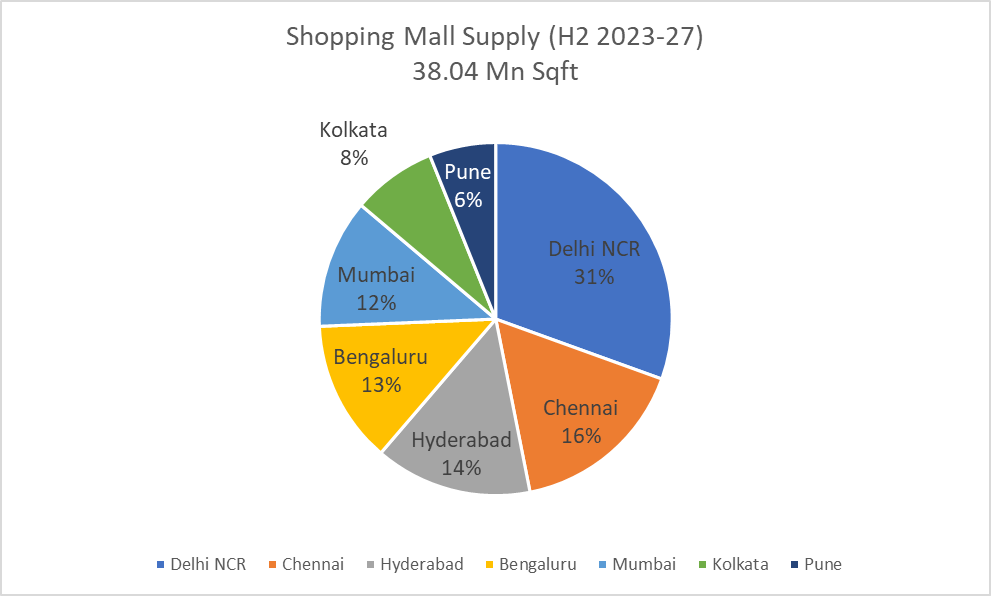

In a big boost to physical retail, prominent developers, global conglomerates, and institutional investors have been at the forefront of announcing and launching quality retail developments. The physical retail space segment has an expected supply pipeline of over 38 million sq ft of retail developments between H2 2023 and 2027, across the top seven cities. Delhi NCR is expected to lead in contribution towards upcoming mall supply with a 31% share, followed by Chennai (16%) and Hyderabad (14%). Around 18% of this upcoming supply (6.7 million sq ft approx.) has institutional participation said Dr. Samantak Das, Chief Economist and Head of Research and REIS, India, JLL

Renewed institutional interest in retail real estate

The maiden listing of India’s first Retail REIT has offered the opportunity for retail investors to own a stake in the retail asset class. Listing of real estate assets through REITs has infused greater transparency in transaction and management structures. The existing retail stock across the top 7 Indian cities offers a potential of ~43-44 million sq ft of *REIT-worthy retail assets, of which more than half are in Mumbai and NCR-Delhi region.

Note: *REIT-worthy retail stock includes organised malls classified as Superior and Good, with a leasable area of at least 100,000 sq ft and current vacancy levels of less than 20% as of June 2023. Malls are classified as ‘Superior’, ‘Good Malls’ and ‘Average Malls’ on the basis of tenant mix, quality of mall management, amenities, vacancy and ownership pattern (strata vs. leased).

With a quality supply pipeline and new malls announced by established developers, the Indian retail sector is expected to attract more institutional investment. The report states that tier I cities continue to attract the maximum investor interest, however, 30% of the institutionally held assets are in tier II & tier III cities such as Amritsar, Chandigarh, Ludhiana, and Mohali in North, Mysuru, and Mangaluru in South, Surat in West, Bhubaneswar in East, Indore, and Nagpur in Central India.

Key themes defining the future of retail in India

Premium outlet centres – Although at a nascent stage in India, the emergence of premium outlet centers is cashing on the changing lifestyle and aspirational choices of young, affluent, and well-traveled Indians. Premium outlets could be a good alternative for landowners/developers looking to create a differentiated product, however optimal brand mix and mall size remain the most crucial parameters.

Highway retailing: Evolving with times

With infrastructure augmentation and an uptick in leisure travel, highway retail is expected to be a big growth driver for the retail sector. With the government promoting Electric Vehicles, many EV charging stations along highways are slated to be set up as part of the overall EV charging infrastructure in the country. Consequently, support retail comprising QSRs, and convenience stores are expected to come up at these EV stations. Entertainment is a fast-moving retail category in highway retail as travel is usually undertaken with family or groups. With an uptick in demand for global brands, more such retailers with an international pedigree are expected to venture toward highway retail.

Also Read: Rental income to increase by 8-10% in FY2024 for retail mall operators