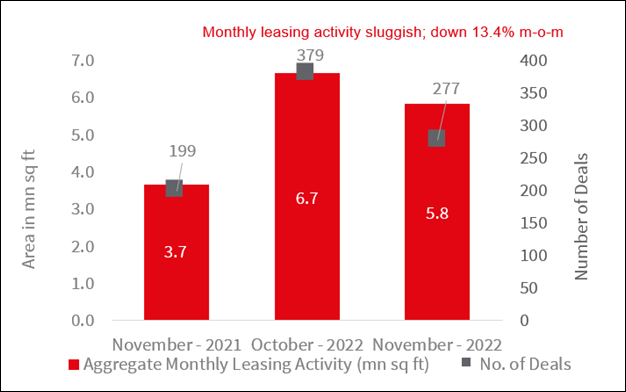

Bengaluru, Mumbai, and Chennai emerge as the top three cities, accounting for nearly 77% of the monthly leasing activity in November 2022

The total monthly leasing activity for the month of November stood at 5.8 million sq. ft and saw a drop of 13.4% on a Month-on-Month (M-o-M) basis. However, on a Y-o-Y basis, leasing activity was up by 59.5%. Fresh leasing with expansion and relocation transactions dominated the bulk of occupier activity during the month. The total leasing activity for the 6-month period of June to November is up by 25.2% as compared to the same period in 2021.

Bengaluru, Mumbai, and Chennai were the top three cities in the same order, accounting for nearly 77% of the monthly leasing activity in November 2022. Mumbai continued to account for the maximum number of deals, followed by Chennai.

“As we approach the end of the year, monthly aggregate leasing activity declined month-on-month in November 2022 as occupiers have turned slightly cautious in the current environment. Global headwinds are creating an environment of uncertainty for business growth projections which is impacting real estate decision-making. We expect that slower tech hiring activity and direction from global HQs may cause a temporary disruption for one to two quarters till the headwinds ease off even as India’s position as the back office and R&D hub for the world is likely to remain intact,” said Dr. Samantak Das, Chief Economist and Head of Research and REIS, India, JLL.

With a 23% share, the IT/ITeS segment reclaimed its place as the biggest driver of aggregate market activity in November 2022. This is the highest in three months, albeit it can be explained by transaction closures back-ended as we approach the year-end with a couple of pre-commitments supporting the increase. Both Consultancies and BFSIs showed a slight decline in their respective shares on an M-o-M basis. Flex remained a key occupier segment and saw its share rise to 12%. The manufacturing/Industrial segment also remained robust, although its share declined on an M-o-M basis.

Global headwinds are slowing down occupier market activity amid delayed decision-making as occupiers keep an eye on the evolving macroeconomic environment and its resultant impact on business growth. While overall market activity remains much better in 2022 compared to the previous two COVID-impacted years and expect slower tech hiring activity and direction from global HQs on business projections may keep occupiers more cautious in the short-term. India’s position as the back-office of the world is likely to remain intact and this should be nothing more than a temporary disruption till the headwinds turn more benign.

Also Read: The India growth story: Office, Residential, and warehousing sectors outperform the industry