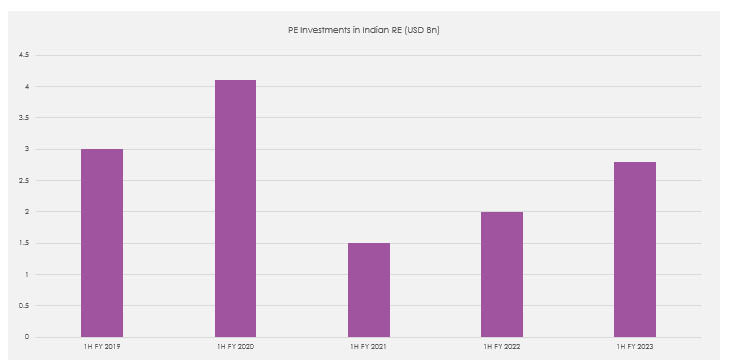

Investor confidence in Indian real estate is increasing steadily on the back of improvement in the Indian economy despite global headwinds, and the continued robustness of its real estate industry. PE investments registered an increase of 40% in 1H FY23 as compared to 1H FY22, reports ANAROCK Capital’s FLUX – H1 FY23 edition.

The Top 10 Deals

These accounted for 86% of the total value of PE investments in 1H FY23 as compared to 80% in 1H FY22.

| Top 10 PE Deals in 1H FY23 | ||||||

| Investor | Investee | Location | Asset Class | Deal Amount (USD Mn) | Debt or Equity | |

| CPPIB | TRIL | Multiple | Commercial | 700 | Equity | |

| Brookfield | Bharti Enterprises | NCR | Commercial | 660 | Equity | |

| Axis AMC | Tishman Speyer | Multiple | Commercial | 188 | Debt | |

| Capitaland Investment | Capitaland Development | Chennai | Commercial | 177 | Equity | |

| Bain capital | TARC (Anant Raj) | NCR | Residential | 175 | Debt | |

| Brookfield | IL&FS | MMR | Commercial | 137 | Equity | |

| Brookfield | L&T | Hyderabad | Land | 129 | Equity | |

| Credit Suisse | Adani Properties | Multiple | Mixed Use | 101 | Debt | |

| Varde Partners | Omaxe Group | Multiple | Mixed Use | 57 | Equity | |

| HDFC Capital | Signature Global | NCR | Residential | 52 | Debt | |

Average Ticket Size

The average ticket size has risen to USD 121 in 1H FY23 from USD 75 in 1H FY22 and USD 106 in 2H FY22. This is largely due to investors’ focus shifting more towards multi-city deals, and deployment by JV platforms.

Movement of Capital Inflow

Shobhit Agarwal, MD & CEO – ANAROCK Capital, says, “Investment focus by PE investors in 1H & 2H FY22 was markedly strong in MMR. In 1H FY23, it has shifted to other regions. NCR witnessed a strong increase in capital inflows in PE – from USD 181 Mn in 1H FY22 and USD 590 M, in 2H FY22 to USD 942 Mn in 1H FY23. There was a 60% rise in investments in 1H FY23 in NCR compared to 2H FY22 due to JV platform deals like Brookfield + Bharti Enterprises and Bain Capital + TARC.”

Equity vs Debt Funding

Equity investments in real estate has witnessed a considerable increase – 43% higher in 1H FY23 compared to same period last year. Debt funding, on the other hand, saw a 20% rise.

Investors’ preference for equity is evident from the fact that the share of equity investments in Indian real estate continues to be healthy at 79% – 300 bps higher than 1H FY22.

Asset Class-wise Funding

“Post pandemic, demand and confidence in the commercial real estate sector has seen a meaningful recovery,” says Agarwal. “PE investments in this space was USD 1,862 Mn in 1H FY23 – almost equivalent to the investment in the whole of last year. The commercial RE space is being preferred by PE investors, as evidenced by the fact that the investment share of commercial assets in the overall real estate pie has increased from 18% and 56% in 1H FY22 and 2H FY22 to 67% in 1H FY23.”

Demand in the residential sector has also remained healthy in post-pandemic times, resulting in the residential asset class being second-most preferred among all asset classes with USD 372 Mn being funnelled into it in 1H FY23. The PE investment figure stood at USD 378 Mn and USD 390 Mn in the 1st half and 2nd half of FY23 respectively.

Domestic vs Foreign Funding

The share of investments by foreign investor continued at around 78% in 1H FY23, clearly reflecting the continued global confidence in India’s real estate industry.

Domestic investments increased by 45% and foreign investments increased by 36% of the total capital inflows in Indian real estate in 1H FY23 compared to 1H FY22.

Key Takeaways

Commercial RE – With many corporates moving from WFH to hybrid mode, demand and confidence in the commercial space has resurged and this is expected to continue for the next few quarters.

Residential RE – Demand in the residential sector is rising due to significantly improved homeownership sentiments amid continued WFH and hybrid work policies by many companies post the pandemic. This will continue to keep the residential space in investor’s focus zone.

Retail RE – Investments in the retail space are expected to remain subdued for the next few quarters until physical shopping comes back to more promising levels.

Industrial & Logistics – Strong e-commerce demand and buoyancy in the manufacturing sector are expected to keep the momentum in industrial and logistics sector upbeat.