MMR has the highest risk of undergoing a price correction where 10% of projects are expected to undergo high correction of more than 20%.

By Varun Singh

The all India residential real estate market closed at an inventory of 13,45,000 units admeasuring 1.58 bn sqft with an overhang of 45 months when the nationwide lockdown was enforced in Mar-20.

This is what a report by Liases Foras, a real estate research firm has revealed. It further says, job losses, salary cuts, reduced savings and uncertainty of a normal world, have induced negativity of the buyer towards home purchase.

The report further says, “The sales velocity clocked in the Mar-20 qtr. was 0.90%. Signs of a healthy market are a sales velocity of 2.08 % and an overhang of 15 months.”

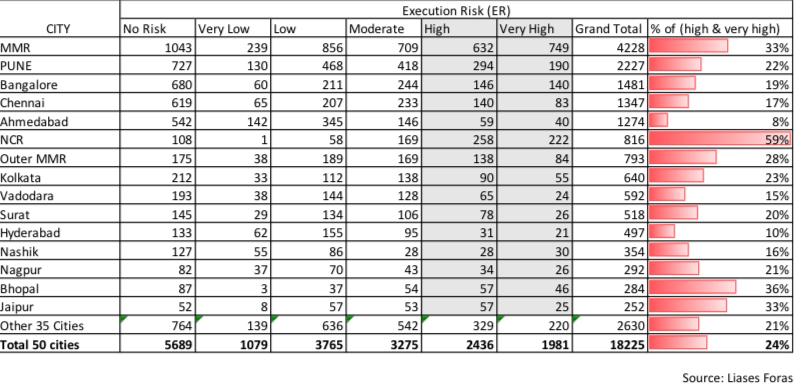

According to Liases Foras, “Nearly 50% of the unsold residential inventory faces a high execution risk. 33% of projects in MMR and 59% of projects in NCR fall in high and very high execution risk categories.”

Report further states, that, the supply side of the market was struggling even before the pandemic had set in. Taking a turn for the worse, COVID-19 and the nationwide lockdown has affected the demand side of the market which is the buyer’s sentiment.

A distressed market puts the already struggling projects (Prior to COVID-19) into a tighter position making them susceptible to default and thereby leading to chances of delinquency.

Analysis by Liases Foras brings out that under the current circumstances, only 50% of the all residential projects are safe from both execution risks and price correction. The remaining 50% are either under risk of being delayed, susceptible to price correction or both.

A region wise distribution shows 5 urban agglomerations of the 15 major urban agglomerations having an execution risk greater than 25%. 33% of projects in MMR and 59% of projects in NCR falls in high and very high execution risk categories.

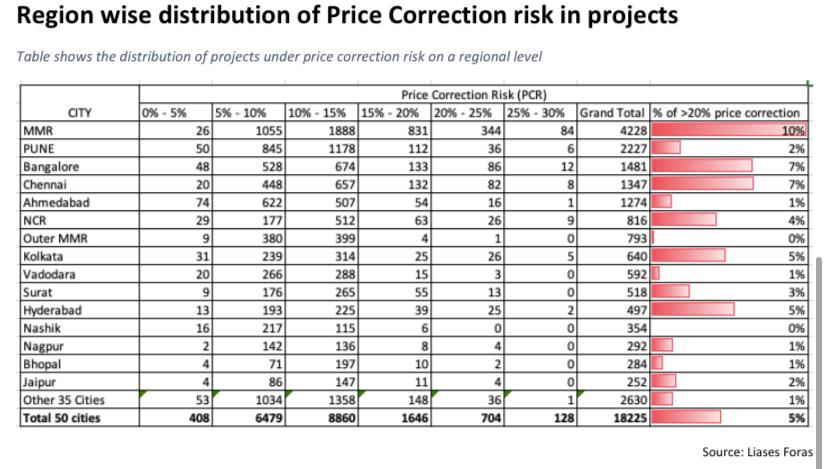

Around 50% of the projects and unsold stock are with moderate price correction risk of 10 to 15%. Only 5% of the projects and consisting around 2% of unsold stock have a scope of over 20% of price correction.

On a region level segmentation, MMR has the highest risk of undergoing a price correction where 10% of projects are expected to undergo high correction of more than 20%. A high price correction is a sign of damage to the financials of the developer and facilitator.

Developers now want government to intervene and listen to their demands to save the real estate industry.

“The report shows that five urban clusters of the 15 major urban groups have an execution risk of over 25%. This includes Mumbai Metropolitan Region (MMR) and National Capital Region with 33% (high risk) and 59% projects (very high risk), respectively,” said Ajay Ashar, Spokesperson, CREDAI Action Committee.

Ashar further added, “To not put the sector, homebuyers and economy in further stress, we urge the government to look into our five point demand. These include one-time debt restructuring, reduction of home loan interest to 5% (or subsidising it to bring it down to that level) to empower the buyer, extension of RERA timeline for project completion to March 2021, GST Input Tax Credit to be extended for new projects and increasing SWAMIH Fund to Rs 1 lac crore.”

Also Read: Residential rentals see a downward slide in Mumbai