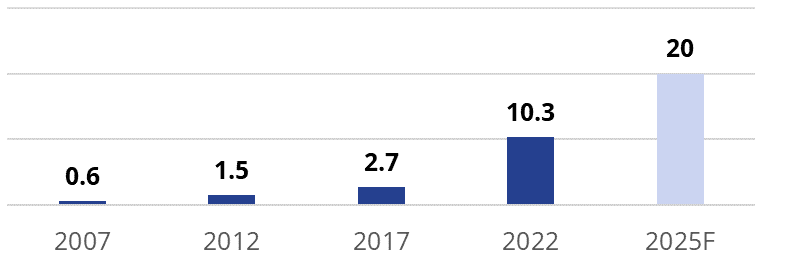

India’s data center stock is likely to double to about 20 mn sq ft by 2025 from current 10.3 mn sq ft, according to Colliers’ latest report “Data center: Scaling up in Green age”. India currently has about 770 MW* data center capacity across top seven cities. The growth of data centers in India is led by massive explosion of data consumption through digitization, increased cloud adoption, etc., over the last two years. At the same time, data center operators are enthused by the incentives such as subsidized land, stamp duty exemption, etc. provided by several states.

Data center growth during 2007 – 2022 (in mn sq ft)

Note: Data pertains to the top 7 cities: Bengaluru, Delhi-NCR, Mumbai, Pune, Hyderabad, Chennai & Kolkata Source: Colliers

Mumbai accounts for the largest share of data centers at 49%, benefitted from the presence of a landing station and submarine cable connectivity. Delhi-NCR has about 17% of the total data center capacity, followed by Bengaluru. While metro cities remain core hubs for data centers, Tier-II cities are also witnessing traction. Currently, Tier-II cities hold only 3% of the total data center stock in India. However, key data center operators are eyeing cities like Vijayawada, Nagpur, Raipur, Kochi, Patna, and Mangalore as potential locations for setting up edge data centers and as disaster recovery sites.

City-wise share of data center capacity

Investments in data centers remain unfazed; cross USD10 bn since 2020

Since 2020, data centers have received cumulative investments of USD10 bn, and have seen surging partnerships between developers and global operators. The investments are from global data center operators looking to expand into India, investments from corporates and real estate developers, and private-equity funds. Rising data consumption, coupled with favorable government policies have spurred investments in the sector in the last 2-3 years.

“Data centers are capital intensive and investors with a long-term horizon are exploring this asset class. While real estate costs are only about 25%, there is ample opportunity for developers and investors in this space. At the same time, there is now a greater need to make data centers more sustainable. At present, only 22% of the existing data center stock is LEED-certified. Global operators are increasingly investing in low-carbon and energy efficient technologies to reduce the impact on the environment and achieve optimum efficiency. Edge data centers are the next big opportunity in India, as these data centers support the sustainable transition of data centers through smaller footprint, and lower energy consumption,” said Ramesh Nair, Chief Executive Officer, India and Managing Director, Market Development, Asia, Colliers.

“The data center Industry is at a breakneck pace at the moment, poised to double up the built space to 20 mn sq ft by 2025. India is getting positioned as a hub for data centers across APAC. With the challenge of expansion in other developed markets like Singapore, India is taking a steady growth linked expansion, connected directly with the end user consumption. With two landing station hubs connecting the country on the west coast and east coast, India managed to create a better fiber penetration into the country, which is leading to increased internal consumption. Edge data centers coupled with 5G launch is going to create additional opportunities in expanding the data center footprint across the country. These Edge data centers are going to create a huge opportunity in the rural employment in India, added Rao Srinivasa, Managing Director, Data Centers, Project Management at Colliers India.

“Indian data center industry has witnessed robust growth between 2012-22 growing at 21% CAGR, led by increased adoption of smartphones, e-commerce and cloud services. Hyperscalers are also rapidly gaining ground and ramping up their investments in India as they plan to set up multiple data centers across key cities. Realizing the market potential and abundance of opportunities in India, investments in data centers are likely to remain popular amongst investors.” says Vimal Nadar, Senior Director, Research, Colliers India.

Also Read: Amazon to pay Rs 1.4k Crore rent over 15 years for a data center in Thane