Hyderabad Leads with 23% RevPAR Surge; Tier II & III Cities Dominate Hotel Expansions

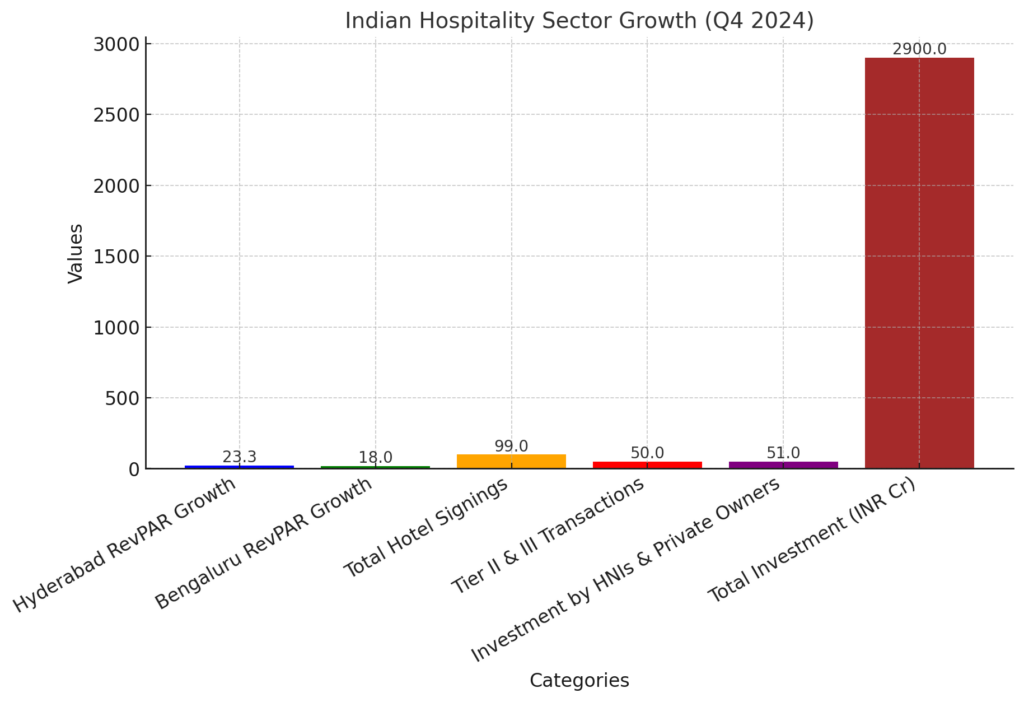

The Indian hospitality sector exhibited robust growth in Q4 (October-December) 2024, with key performance indicators such as Average Daily Rate (ADR) and Revenue Per Available Room (RevPAR) seeing notable year-over-year increases across the top six markets. Hyderabad emerged as the strongest performer, registering a remarkable 23.3% RevPAR growth, primarily driven by an increase in ADR. Bengaluru followed closely, showcasing significant gains due to improvements in both ADR and occupancy rates.

Surging Investment and Expansion

The last quarter of 2024 saw remarkable activity in hotel signings, with 99 new hotel projects being inked, accounting for a total of 11,943 keys. This strong pipeline of developments highlights continued investor confidence in the Indian hospitality sector. In terms of transactions, the sector witnessed an estimated investment of INR 2,900 crore for the year, underlining significant capital inflow.

Tier II & III Cities Take Center Stage

An interesting shift in investment focus was observed, with Tier II and Tier III cities securing 50% of the total hotel transactions. This trend reflects the growing interest in expanding hospitality infrastructure beyond metropolitan hubs. Notably, unbranded midscale properties dominated these investments, signaling rising demand for affordable accommodation in emerging cities.

Furthermore, 75% of new hotel signings in Q4 2024 were concentrated in Tier II and III cities, emphasizing their growing role in the industry’s expansion. The midscale segment accounted for 53% of hotel openings and 44% of new signings, reflecting a strategic push toward catering to the evolving needs of domestic travelers.

Diverse Investment Base & Emerging Hotspots

The investment landscape in 2024 saw diverse participation, with High-Net-Worth Individuals (HNIs), family offices, and private owners contributing 51% of the total investment volume. This indicates a shift towards more private and boutique investments in the hospitality space.

Among key states, Uttar Pradesh led in hotel signings, contributing 1,744 keys to the sector’s growth. Additionally, emerging hotspots such as Delhi’s Yashobhoomi and Mumbai’s airport district are drawing increased investor attention, suggesting strong future potential for these locations.

Industry Outlook & Future Growth

The Indian hospitality industry has been on an upward trajectory, bolstered by robust domestic travel demand across both business and leisure segments. This trend has encouraged fresh investments, particularly in Tier II and III towns. Overall, 2024 witnessed 367 new hotel signings and 154 hotel openings, marking a 14% growth over 2023.

Jaideep Dang, Managing Director, Hotels and Hospitality Group, India, JLL, commented on the positive momentum: “Hospitality markets in India saw unprecedented activity in 2024. The strong demand for business and leisure travel has attracted several new investors to build hotels, particularly in Tier II and III cities. This expansion will drive construction, lending, and job creation across the hospitality ecosystem.”

With continued expansion, increased investments, and emerging opportunities in non-metro locations, the Indian hospitality industry appears well-positioned for sustained growth in 2025 and beyond.

Also Read: The evolving face of human capital in the hospitality industry