Institutional investments in the Indian real estate sector have witnessed robust growth in the first quarter of 2025, reaching USD 1.3 billion—an impressive 31% year-on-year (YoY) increase, according to the latest report by Colliers India. This surge in investments was predominantly driven by domestic inflows, which accounted for 60% of the total investments, marking a substantial 75% annual rise.

Office Segment Leads Investment Inflows

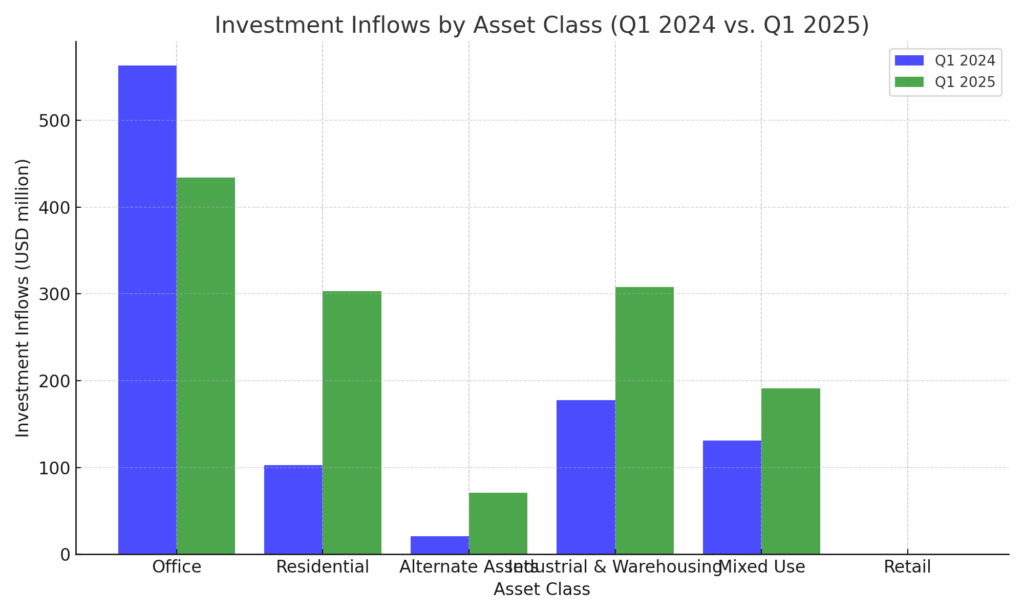

The office segment remained the dominant asset class, accounting for one-third of the total inflows with investments totaling USD 0.4 billion. Hyderabad emerged as the prime location for office investments, attracting over half of the segment’s capital during Q1 2025.

Strong Growth in Residential and Industrial Segments

Residential investments soared nearly threefold compared to Q1 2024, reaching USD 0.3 billion and contributing 23% to the total inflows. Foreign investments accounted for over half of the residential capital, driven by significant large-scale deals and joint ventures between global investors and local developers.

The industrial and warehousing segment also maintained momentum, recording USD 0.3 billion in investments—representing a 73% YoY increase. The positive performance of macroeconomic indicators, including a high Manufacturing PMI of 58.1 in March 2025, boosted investor confidence in the segment.

Rise of Alternate Assets

Investment inflows into alternate assets, such as data centers and senior housing, remained strong at USD 0.07 billion. Data centers, in particular, gained traction, supported by capital deployment in a proposed hyperscale data center in Mumbai.

City-wise Investment Breakdown

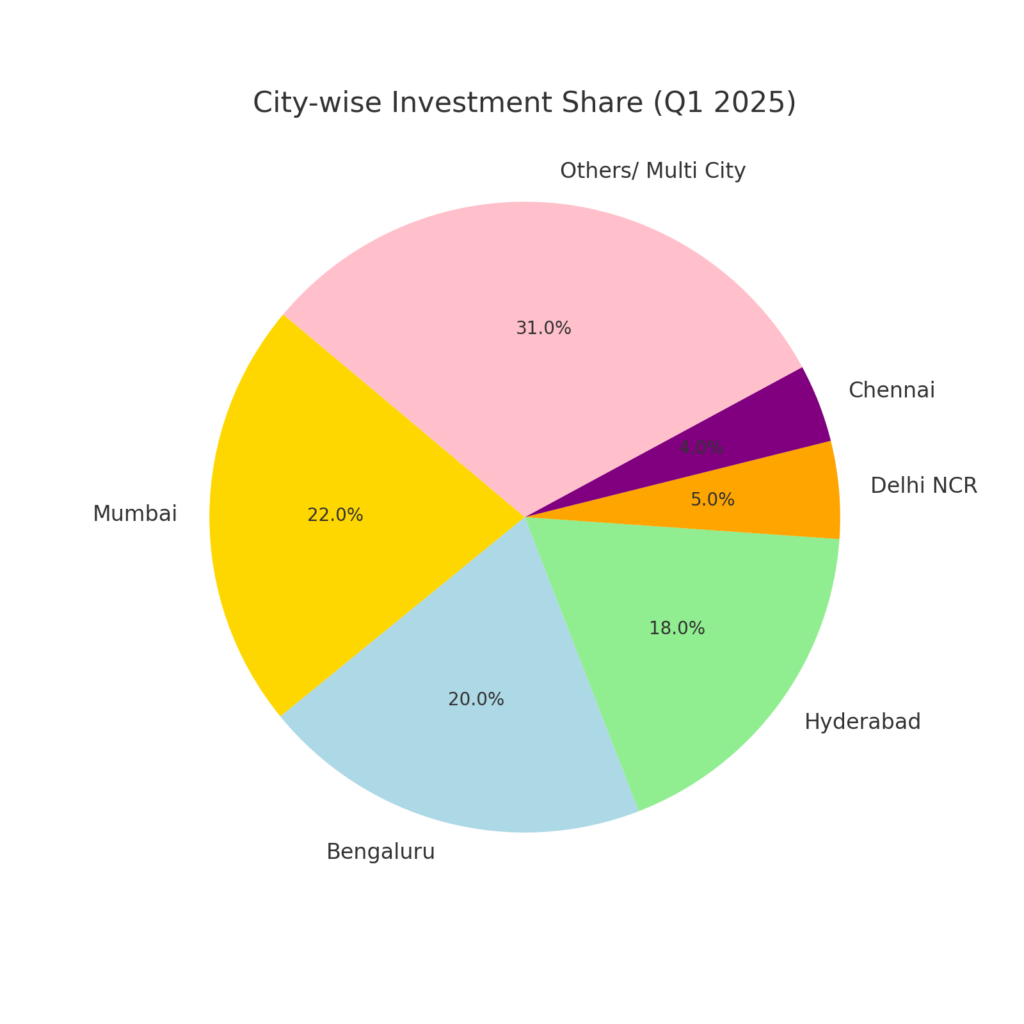

Mumbai led the city-wise investment share with USD 0.3 billion, accounting for 22% of total inflows—a remarkable 841% YoY growth. Bengaluru and Hyderabad followed, with 20% and 18% shares respectively. Multi-city deals also constituted a significant 31% of overall investments.

Expert Insights

Badal Yagnik, CEO of Colliers India, noted, “Institutional investors continue to exhibit confidence in Indian real estate as investments rose by 31% YoY to USD 1.3 billion in Q1 2025. The sustained momentum, supported by strong economic growth and favorable policies, is expected to continue throughout the year.”

Vimal Nadar, Senior Director and Head of Research at Colliers India, added, “The residential segment has seen a significant surge in demand, driven by rising luxury housing trends and strategic joint ventures between global investors and local developers. The potential reduction in repo rates could further stimulate mid and affordable housing investments.”

Outlook for 2025

Experts anticipate that the positive investment momentum will persist, bolstered by optimistic economic projections, robust demand, and proactive government measures. The anticipated easing of monetary policy may further catalyze investments, especially in residential and industrial segments.

Also Read: APAC Investor Optimism to Drive Institutional Investments in Indian Real Estate in 2025