- Platform funds gain prominence with announcements of USD 19 billion in the last 10 years; 79% of these were formed in the last five years

- Indian real estate attracts USD 62.8 billion in the last 16 years; 58% of the total was invested in the last 7 years, driven by increasing reforms in the sector

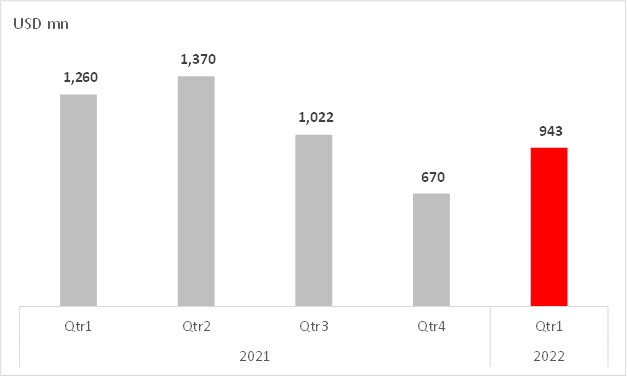

- Investment momentum grew by 41% during Q1 2022 over Q4 2021 at USD 943 million

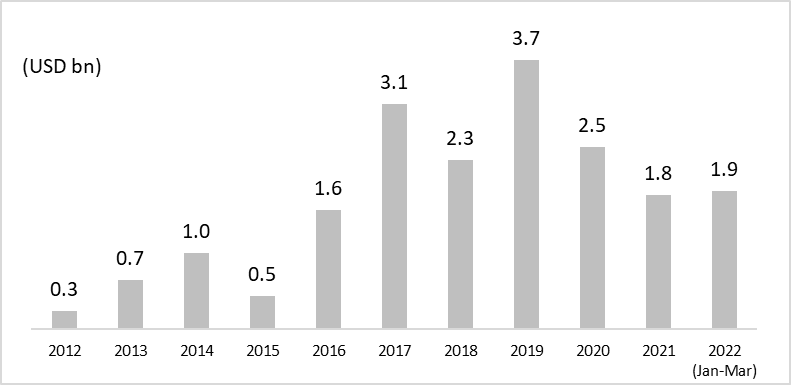

Dedicated investment platformshave come a long way with a total announcement of USD 19 billion commitments from 2012-March 2022, according to JLL’s India Capital Market Review. Of these 79% of the platforms were formed during the last seven years primarily led by market-friendly reforms like Real Estate Investment Trusts (REITs) and Goods and Services Tax (GST). Investment Platforms are like co-investment vehicles formed to invest in a large pool of assets in the same sector.

79% of the total investment platforms have been formed during 2017-Q1 2022

“The lifting of restrictions led to a pick-up in investment momentum during Q1 2022. This quarter saw a 41% jump in institutional investments over Q4 2021. While domestic capital chased deals in the residential sector, foreign investors were largely seen focusing on commercial assets. Healthy leasing momentum has brought back-office demand with investors entering JVs/ development partnerships. Retail also continued to see good traction with some opportunistic deals in the market” said Lata Pillai, Managing Director and Head, Capital Markets, India, JLL.

“Deal flow currently looks very healthy, with USD 943 million transacted in Q1 and with several large deals in the pipeline we expect 2022 investment volumes to be at par with 2018 and 2019 (pre covid) levels. Data centre and warehousing would remain sectors to watch out for as many hands chasing few opportunities will lead to competitive pricing and compressing cap rates,” she added.

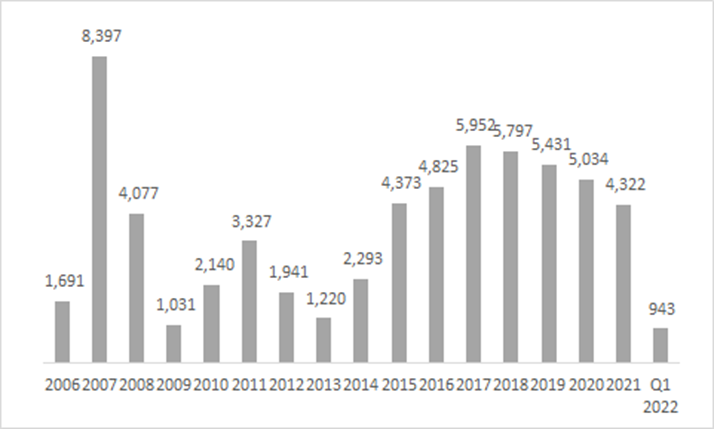

USD 62.8 billion investments in real estate driven by increasing reforms in the sector

The series of reforms that started in 2014 led to increased capital flows over the years. Out of the total Institutional investment of USD 62.8 billion from 2006 to March 2022, 58% was received from 2015 onwards. The key reforms like the introduction of REITs in 2014, the Real Estate (Regulation and Development) Act (RERA) in 2016, the Benami Transactions (Prohibition) Act, GST, and the progressive relaxation of foreign direct investment (FDI) norms over the years led to improved transparency, accountability, professional management, and development of markets for smoother entry and exit of capital. The positive impact of the reforms resulted in investments to the tune of USD 36.7 billion flowing into Indian real estate from 2015- to Q1 2022.

“The preference of large investors for active participation in the investment process and focused asset classes has led to the rise of joint venture/club type investment platforms. Dedicated investment platform deals/funds which were first initiated in 2012 have come a long way with a total announcement of USD 19 billion commitments till March 2022. The warehousing sector post-GST reforms witnessed platform funds accounting for the highest share of 34% of the USD 19 billion commitments announced. The affordable housing segment which has seen a regulatory push in the last few years has seen focused platforms accounting for an 18% share of the total announced.” said Dr. Samantak Das, chief economist and head of research and REIS, India, JLL.

59% of total institutional investments received during the last 7 out of 16 years

GST reforms led to a sharp rise in warehousing sector investments

Institutional investments witnessed a sharp rise from a mere USD 100 million during 2006-to 16 to USD 2.3 billion after 2017. The introduction of the Goods and Services Tax regulation changed the prospects of the warehousing sector in India. The concept of ‘One Nation One Tax’ led to the consolidation of space and the need for large Grade A- Warehouses. The growth of e-commerce has galvanized the growth of the warehousing sector. The demand for new-age warehouses has led to development stage investments in the sector. In addition to USD 2.3 bn worth of investment in this segment during 2017-Q1 2022, the institutional flow of funds has also been routed through investment platforms / joint ventures.

Warehousing sector investments shoot up due to GST reforms

Investment momentum grew by 41% during Q1 2022 over Q4 2021

The waning of uncertainty due to pandemic resurgence led to a pick-up in investment momentum during Q1 2022. Complete relaxation of restrictions over the quarter resulted in investors getting active. This led to the conclusion of deals worth USD 943 million during the quarter.

Looking ahead

Indian real estate has proved its resilience with all asset classes at various stages of recovery. A healthy pipeline of deals is expected to be concluded during the year. Apart from the traditional assets like office and retail, data centres and warehousing would remain sectors to watch out for as many hands chasing few opportunities will lead to competitive pricing.