Pune Industrial & Warehousing demand is expected to clock an all-time high of 7.5 million sq. ft in 2022: JLL

The Pune industrial and warehousing market has grown rapidly, with the current stock at 33.2 million sq ft in 2021. The forecasted supply is close to 60 million sq. ft until the end of 2025. As we have seen, over the past few years, Grade A supply has attracted quality tenants. Pune has been a manufacturing hub since the 1960’s, and has attracted several large multinational corporations, focused on auto, auto and ancillaries, electronics, white goods, and some of the newer industries like Electric Vehicles (EVs) and renewables.

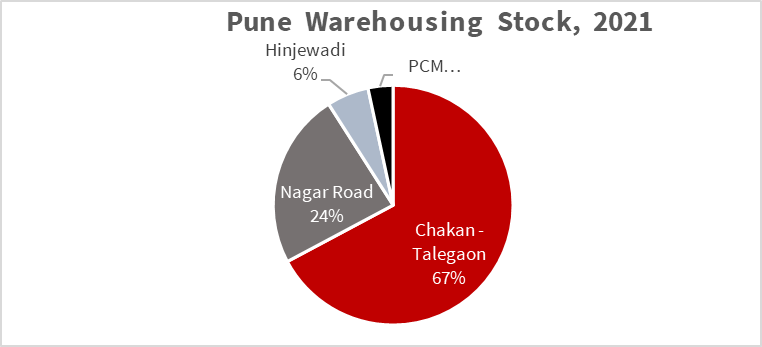

The supply is predominantly concentrated in the Northern part of the city namely Chakan and Talegaon and the Eastern belt starting from Phulgaon to Ranjangaon. Chakan and Talegaon account for almost ~70% of the industrial & warehousing supply, owing to the excellent ecosystem set up by the MIDC, including the physical infrastructure, roads, water, power, and connectivity to National Highways and JNPT.

The Pune story in numbers

| Supply average annual between 2017 & 2021 (Million sq ft) | 4.1 |

| Net absorption average annual between 2017 & 2021 (mn sq ft) | 3.7 |

| Rents as of 2021 (INR per sq ft per month) | 17-30 |

| Stock as of 2021 (mn sq ft) | 33.2 |

Micro markets grow substantially

Pune witnessed peak demand of 6.5 million sq ft in 2021, indicating clear resurgence of the economy as well as customer sentiments, led by manufacturing, 3PL and e-commerce. Additionally, the city witnessed increased interest from global investors and funds, evaluating further investments. Projected growth in demand is ~15-16% in 2022 to take it to 7.5 million sq. ft by the end of 2022.

Talegaon is an upcoming industrial and warehousing market in proximity to Chakan, connected via the NH4. The micro-market has limited ready supply on offer for clients. Chakan – Talegaon cluster is the largest warehousing hub in the city, with a concentration of Grade A spaces, and has the largest amount of demand contribution on an annualized basis. Pimpri-Chinchwad Municipal Corporation (PCMC), India’s oldest automobile industrial area has more than 4,000 auto and ancillary units. PCMC is characterized by SMEs MSMEs and Large Indian and Multinational corporations operating within the micro-market.

“The Pune market has been characterized by excellent demand-supply dynamics over the few years, which resulted in vacancy levels hovering around the 10%. We expect the healthy demand-supply dynamics to continue over the next few years, making Pune one of the most attractive markets in the country for the development of industrial parks and warehouses,” said Sanjay Bajaj, Managing Director – Logistics and Industrial, India, JLL & Pune, JLL.

Key lease transactions in the last 2 years (2020-2021) done by JLL

| Sr. No | Location | Size of Transaction | Year of Transaction |

| 1 | Phulgaon | 167,000 sq.ft. | 2021 |

| 2 | Sanaswadi | 101,000 sq.ft. | 2021 |

| 3 | Chakan | 65,000 sq.ft. | 2021 |

| 4 | Chakan | ~800,000 sq.ft | 2020-2021 |

| 5 | Talegaon | 70,000 sq.ft. | 2020 |

| 6 | Chakan | 82,000 sq.ft. | 2020 |

Looking ahead

The year 2022 looks extremely promising for the Industrial & warehousing sector of Pune. Historically, considering the slump in demand during COVID the city has witnessed approx. 4 million sq. ft of annual absorption from 2017-to 2021. JLL excepts 2022 demand to be quite solid, owing to the renewed confidence in the Indian economy and special focus on the manufacturing sector as well as the buoyancy of E-commerce and 3PL players, which shall further propel demand. This could potentially lead to the all-time high demand of ~7.5 million sq. ft.