The Reserve Bank of India (RBI) has issued a statement on various Developmental and Regularities Policies Measures in which individual housing loans and commercial real estate funding by cooperative, district central cooperative banks and the state cooperative banks have been considered.

As per the notification of RBI, the District Center Co-operative Bank and State Co-operative Banks are allowed to grant finance to Commercial Real Estate – Residential Housing within the existing aggregate housing finance limit of 5% of that total asset.

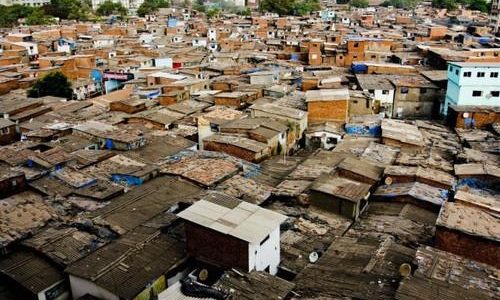

Due to this notification by RBI, Mumbai Bank as well as Maharashtra State Co-operative Bank & Other District Co-op Banks will be able to grant loans to housing societies, who are opting for Self-Redevelopment.

The individual housing loans by cooperative banks limit of 2011 has been doubled after 11 years. Considering the needs of the customers the individual housing loans for tier I cooperative banks has been enhanced from Rs.30 lakhs to Rs.60 Lakhs and for tier II of Co-operative Banks from Rs. 70 Lakhs to Rs.140 Lakhs. Because of this revision individuals can approach even District Centre Co-operative Banks & other co-operative banks to get the higher loan amount.

Similarly, RBI has allowed the District and State Cooperative banks to grant self-redevelopment funding to the housing societies. This has become possible due to the constant follow up made by Abhishek Ghosalkar, Chairman of Mumbai Suburban District Housing Federation and the Director of Mumbai Bank representing nearly 35,000 housing societies in Mumbai. Since 2016 Mumbai Bank under the leadership of Shri. Abhishek Ghosalkar was granting funds to the housing societies for Self-Redevelopment. However, in the year 2019 when the state government appointed Maharashtra State Cooperative Bank as a nodal agency to grant the self-redevelopment funding, the RBI restrained the Mumbai Bank and Maharashtra State Cooperative Bank to lend the self-redevelopment funds to the housing societies considering the same as Commercial Real Estate funding.

Abhishek Ghosalkar says that Self Re-development is a best alternative for housing societies to start the Re-development considering the stalled projects and the default committed by a number of Developers.

Self-Redevelopment provides maximum security to the members, less litigation and provides additional benefits to the members in the form of Additional Area, Additional Corpus over and above what the Developer offers.

Abhishek Ghosalkar says the Mumbai Suburban District Federation has constituted a separate free advisory Cell to guide Housing Societies looking for Self-Redevelopment from beginning till the OC is obtained.

Due to the constant follow up made by the Mumbai Bank, Maharashtra Societies Welfare Association and Shri. Abhishek Ghosalkar, Chairman, Mumbai Suburban District Housing Federation Ltd the major relief for the funding for self-redevelopment could be achieved.

CA, Ramesh Prabhu – Chairman of Maharashtra Societies Welfare Association (MahaSewa) is of the opinion that because of the RBI New Policy the Self Re-development will get required funds from the banks which will boost Self Re-development.

Also Read: RBI’s Repo Rate Hike may impact real estate demand: Realtors