The Reserve Bank of India’s (RBI) forthcoming monetary policy announcement is anticipated to significantly impact various industries and financial markets, particularly the housing sector. Given that most home buyers in India rely on home loans, changes in acquisition costs are especially crucial. A potential cut in the repo rate could lead to lower interest rates on home loans, making monthly equated installments (EMIs) more manageable for borrowers.

However, interest rates are just one piece of the puzzle. Property prices also play a critical role in influencing purchase decisions. According to ANAROCK Research, average residential property prices across the top seven cities in India have surged by 46% since 2021. More favorable interest rates could enhance overall affordability, potentially catalyzing housing sales during the upcoming festive season. Increased sales would benefit developers by improving cash flows and lowering borrowing costs for ongoing projects.

Moreover, a rate cut could revitalize market sentiment and attract investors back into the housing sector. Following years of stagnation, investors began returning to the market post-COVID-19, drawn by rising demand and prices. However, many have since adopted a cautious stance as property prices appear to have stabilized. More attractive lending rates could encourage these investors to re-engage with the market.

That said, experts urge caution. While recent cuts by the US Federal Reserve might suggest a similar move by the RBI, the global economic landscape is currently fraught with uncertainty due to ongoing geopolitical tensions. As such, the RBI may choose to maintain the current repo rate until these pressures subside.

As stakeholders await the announcement, the housing market remains on edge, hopeful for a boost that could drive sales and investment in the sector.

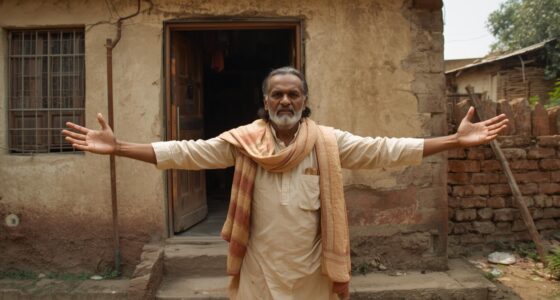

Note: This Article is based on the insights of Anuj Puri, Chairman, Anarock Properties

Also Read: Unchanged RBI Repo Rates: A Boon for Real Estate Growth