Despite a sluggish start to the fiscal year, residential sales in India’s top seven cities are anticipated to experience double-digit growth in FY2025, according to a recent report by ICRA. The outlook for the residential real estate sector remains stable, supported by strong demand and healthy cash flows.

Sales Growth and Market Dynamics

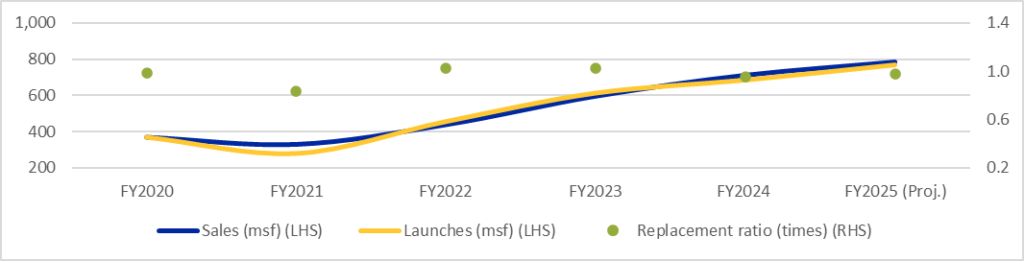

ICRA forecasts a 10-12% increase in the area sold across the top seven cities, estimating it to reach between 785 and 800 million square feet (msf) in FY2025. This growth follows a high base in FY2024. Although the sales growth rate has moderated, the overall sales velocity, collections, and inventory levels are projected to stay robust. The report highlights that new launches are expected to rise by 12% year-on-year (YoY) to 767 msf in FY2025. This increase is attributed to historically low inventory levels and strong demand.

As of June 2024, inventory levels had decreased to 687 msf from 732 msf in March 2023, with a low years-to-sell (YTS) ratio of 0.9 times. This indicates a favorable market environment with balanced sales and launches.

Financial Outlook

Anupama Reddy, Co-Group Head & Vice President– Corporate Ratings at ICRA, noted that despite a slower first quarter, the residential real estate market is poised for substantial growth. Sales in FY2024 saw a healthy 19% YoY increase, with a consistent rise in quarterly sales over the past eight quarters, excluding the traditionally weaker first quarters.

The report also indicates that while gross debt is expected to increase by 6-7% in FY2025 due to new business development and ramped-up project execution, leverage will remain comfortable. The ratio of gross debt to cash flow from operations (CFO) is projected to be between 1.55 and 1.60 times as of March 2025, a slight improvement from 1.63 times in March 2024.

Price Trends and Market Sentiment

The average sale price (ASP) of residential properties rose by 11% in FY2024 and is expected to increase by an additional 5-6% in FY2025. This price growth is driven by a higher proportion of luxury units and greater pricing flexibility due to reduced inventory. The shift in consumer preferences towards larger spaces, influenced by the pandemic, has led developers to realign their product offerings accordingly.

Reddy emphasized that despite the anticipated rise in gross debt levels, leverage will remain manageable, supported by strong cash flows. The overall outlook for the residential real estate sector remains stable, reflecting a positive trajectory for the coming fiscal year.

Conclusion

ICRA’s report underscores a resilient residential real estate market in India, with strong growth prospects and stable financial conditions. The anticipated rise in sales and prices, coupled with manageable leverage, paints a promising picture for the sector in FY2025

Source: Propequity, ICRA Research