According to Vestian’s latest report, the warehousing & logistics (W&L) sector witnessed a significant surge in investments in 2024, receiving a total of USD 1.96 billion. This accounted for 29% of the total institutional investment in the real estate sector, marking a remarkable 203% year-on-year growth. The sharp rise in investment was driven by increasing demand for warehouses, primarily fueled by the expansion of the quick commerce sector.

Investment Trends in Warehousing & Logistics

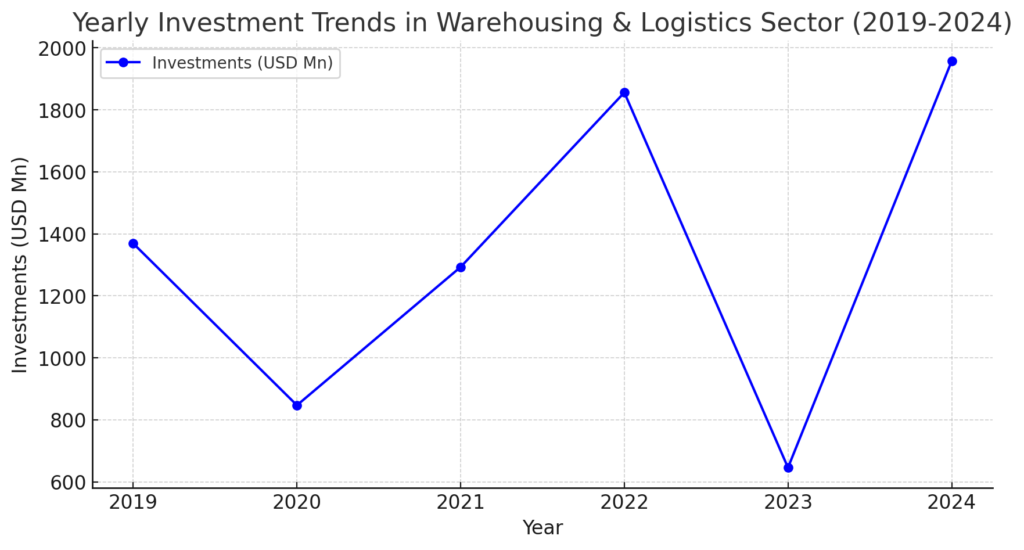

The past few years have seen fluctuating investment patterns in the warehousing and logistics sector. Despite a dip in 2023, investments rebounded strongly in 2024. The year saw the second-highest investment influx in the last six years, demonstrating growing investor confidence in the sector.

Year-wise Investment Trends

| Year | Investments (USD Mn) | % Share in Total Investments |

|---|---|---|

| 2019 | 1,369.0 | 4% |

| 2020 | 847.0 | 14% |

| 2021 | 1,293.0 | 27% |

| 2022 | 1,856.0 | 31% |

| 2023 | 645.8 | 15% |

| 2024 | 1,957.4 | 29% |

Record Absorption in 2024

The demand for warehousing space reached an all-time high in 2024, with a record absorption of 44.9 million sq. ft. This marked a 19% increase over the previous year. Notably, the second half of 2024 alone accounted for 28.3 million sq. ft. of absorption, a 70% jump compared to the first half—the highest ever recorded in a single year.

Yearly Absorption Trend

| Year | Absorption (Mn sq ft) | Annual Change (%) |

| 2019 | 33.0 | – |

| 2020 | 21.0 | -36% |

| 2021 | 30.2 | 44% |

| 2022 | 31.2 | 3% |

| 2023 | 37.8 | 21% |

| 2024 | 44.9 | 19% |

Sector-wise Absorption Trends

The absorption of warehousing space varied across different sectors, with 3PL companies leading the demand, though their share saw a decline compared to the previous year. Meanwhile, the engineering and manufacturing sector saw a significant uptick in absorption, driven by government incentives such as the Production Linked Incentive (PLI) scheme and the Make in India campaign.

Sector-wise Absorption in 2024 vs. 2023

| Sector | 2024 | 2023 |

| 3PL | 33% | 44% |

| Engineering & Manufacturing | 24% | 18% |

| Consumer Goods & Services | 7% | 6% |

City-wise Analysis

Warehousing absorption across major cities showed significant variations, with some cities witnessing a surge while others experienced a decline. Mumbai emerged as the leader in absorption, while NCR recorded the sharpest decline.

Highlights of City-wise Absorption:

- Mumbai reported the highest absorption at 18.6 million sq. ft. in 2024, growing by 82% compared to 2023. This surge is attributed to improved connectivity via the Navi Mumbai airport and the rise of quick commerce in major tier-1 cities.

- Pune recorded the highest growth rate in absorption among the top seven cities, increasing by 85% to 13 million sq. ft. However, rental rates declined by 3% to INR 22.9/sq ft/month.

- Chennai, Hyderabad, and Kolkata together accounted for 15% of the total absorption in 2024, down from 22% in 2023.

- NCR saw the most significant decline in absorption, dropping by 55% from the previous year. The region’s share in pan-India absorption plummeted from 23% in 2023 to just 9% in 2024.

City-wise Share in Absorption

| City | 2024 | 2023 |

| Bengaluru | 6% | 10% |

| Chennai | 6% | 9% |

| Hyderabad | 7% | 8% |

| Pune | 29% | 19% |

| Mumbai | 41% | 27% |

| Kolkata | 2% | 4% |

| NCR | 9% | 23% |

Rental Trends

- Chennai had the highest rental rates in 2024 at INR 24.2/sq ft/month, witnessing an 11% increase due to limited land availability within city peripheries.

- Mumbai emerged as the most affordable warehousing market in 2024, with an average rental of INR 18.1/sq ft/month.

- Pune saw a depreciation in rental rates by 3%, bringing the average to INR 22.9/sq ft/month.

Key Takeaways:

- Investments in the W&L sector surged by 203% year-on-year, underscoring strong investor confidence.

- Warehousing absorption hit a record high of 44.9 million sq. ft., with Mumbai leading at 18.6 million sq. ft.

- The 3PL sector remained dominant but showed signs of fragmentation, while engineering and manufacturing saw increasing demand.

- Mumbai and Pune were the biggest gainers in terms of absorption, while NCR saw a sharp decline.

- Rental trends varied significantly, with Chennai experiencing the highest appreciation, while Mumbai remained the most affordable market.

Looking ahead, India’s position as a key logistics hub is expected to strengthen further. Positive investor sentiment, government policies, and infrastructure advancements will continue to shape the sector. However, challenges such as limited skilled workforce availability, regulatory hurdles, and land acquisition costs may need to be addressed to sustain this growth trajectory.

SFI Analysis

The warehousing and logistics sector in India demonstrated resilience and growth in 2024, fueled by increasing institutional investments and rising demand. The surge in quick commerce, robust infrastructure development, and government-led initiatives contributed significantly to this momentum.

Also Read: India’s tallest warehouse