Affordable homes in Mumbai’s nearby areas may become affordable, the reason being the rising input cost of raw materials.

By Varun Singh

Affordable homes may soon become unaffordable, the reason being the rising input cost of raw materials. Now the apex body of real estate developers in the city CREDAI-MCHI has sought government intervention for introducing new measures to control rising input costs.

From raising prices of unsold inventory to reducing supply chain costs, tops the consideration list for CREDAI-MCHI. The apex body for real estate developers confirmed that it looking at rigorous measures to control the rising input cost of raw material which catapulted the cost of construction to the tune of Rs 400-600 per square feet in the affordable housing segment. This has negatively impacted the developers nationwide as the pressure continues to pile on.

While CREDAI-MCHI denied claims of halting construction work in the state as of now but will consider if other ongoing measures don’t provide necessary respite. Some of the measures that are currently being considered include raising the prices of the unsold inventory which has not been delivered, by 10-15% to cover the rising input costs. This move will not only impact the 2,773 projects which were approved by MCGM in 2021 but many more to the extent of 2.60 lakh units over the course of the next three years.

While the recent plea for deferment of the Metro Cess along with discussions on reducing the stamp duty, reforms CREDAI-MCHI continues to stress upon, Secretary Dhaval Ajmera stated, “AS an apex body, we are deeply concerned about the evolving situation on increasing costs of raw materials like steel, cement and its strong impact on affecting the ongoing growth. Developers have absorbed this incremental cost for a long time now and will now look at passing it on to the homebuyers as they have no choice. We will continue to engage in dialogues with various ministries and concerned authorities to consider our recommendations regarding gradual reduction in steel exports, input tax credits being allowed under the GST scheme and the tax saving option of section 80-IB to be extended to the affordable housing category.”

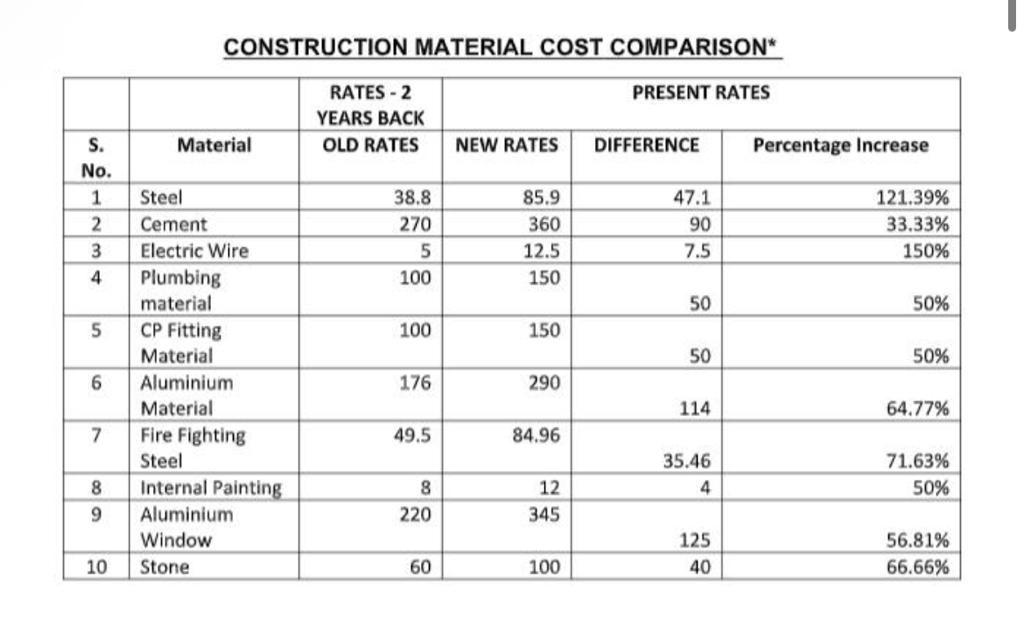

While the price hike forecast was long foreseen given the steep rise in prices of steel, cement, aluminum, PVC rose sharply between 30-100% during the last year itself, the continuously dynamic situation has not helped provide a conducive environment for business as well. Now as an impact of the war, rising, cement and steel prices along with the rise in prices for fuel, have turned into one of the main points of concern.

The rise in pet coke, coal, and fuel coasts as well as freight rates, are all contributing to an increase in cement prices, one of the most integral part raw materials for the real estate industry. While the sector has remained resilient, more than a 40% increase in raw material prices is a concerning sign for the realty industry.

A recent report by CREDAI-MCHI drew insights based on the analytics drawn in the MMR Housing report, which foresees a 7-8% price rise over the next 12 months if the quarterly rise of 2% price hike continues into the current year. The forecast is that prices will rise much more in the coming quarter given the current disruptions in Russian and Ukrainian businesses as well as daily increment in fuel prices, this could lead to an impediment to the growth of the sector. CREDIA has urged the government to show promising support and intervene in price escalation.

Saransh Trehan, Managing Director, Trehan Group said, “Prices of cement and steel have increased sharply over the last two years. Steel price has increased over 100%, whereas cement price has gone up by more than 30% in the last two years. Similarly, be it cost of aluminium materials, electric wire, Paints, stone all are up by more than 50% during the same period. This has led to a sharp increase in our per square feet construction cost. We have not been able to pass on the increase in input cost to customers. But relentless rise in input costs is hurting our profit margins in a big way, and forcing us to think about the future course of action.”

Also Read: Cost of construction up 10-12% likely to push up real estate prices