Covid-19 Impacts Vertical Growth – High-Rises Supply Share Dips to 52% in 2021 reveals a report.

By Varun singh

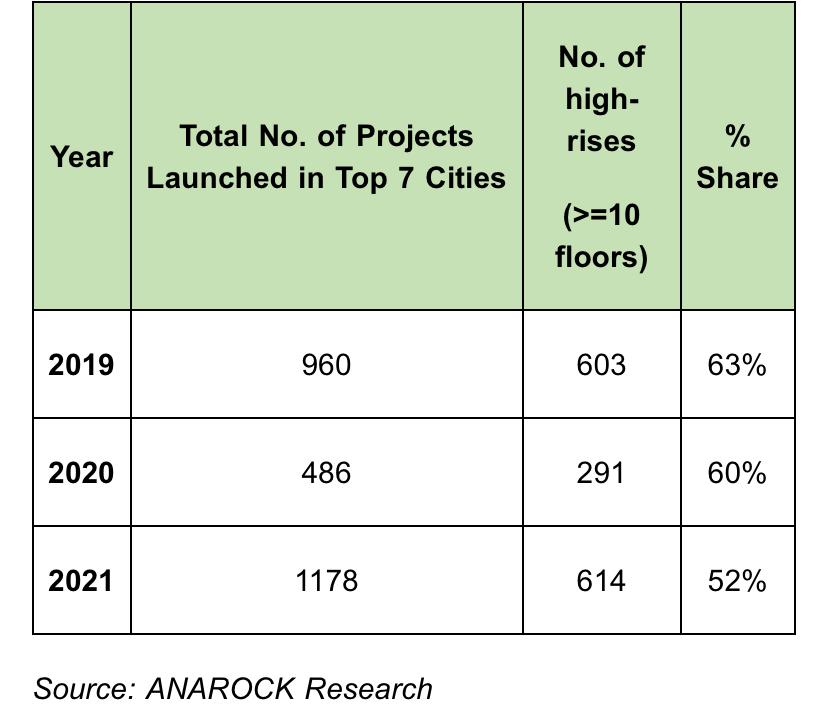

Vertical growth, one of the most defining characteristics of Indian urbanization in over a decade, has become Indian real estate’s latest Covid-19 ‘casualty’. Latest ANAROCK research reveals that among new projects launched since 2019, the share of high-rises had shrunk to 52% in 2021 against 63% in the pre-Covid year.

Of 1,178 projects launched in the top 7 cities in 2021, approx. 614 were high-rises of G+10 floors or more. In 2019, over 603 of 960 projects were high-rises. Newly launched projects include apartments, villas and row houses, and independent floors.

In 2020, over 291 (60%) of 486 residential projects launched in the top 7 cities comprised high-rises.

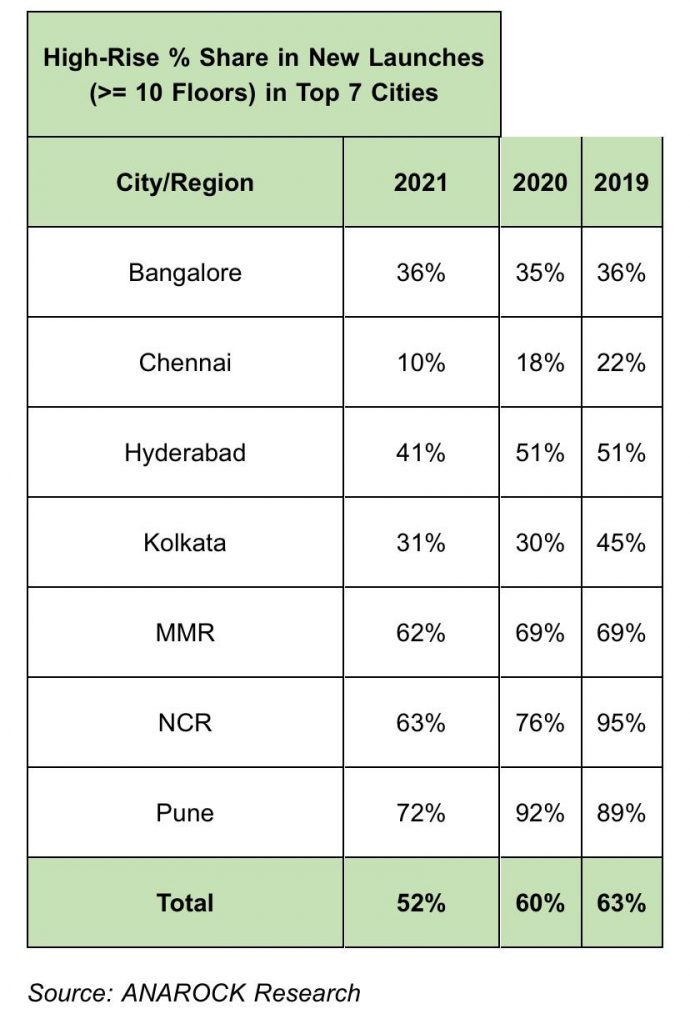

NCR witnessed the most notable change in new project typologies. Of 62 new projects launched in NCR in 2021, around 39 (63%) were high-rises – denoting a 32% decline since 2019. In 2019, among a similar number of new projects (61), a significant 95% (58 projects) were high-rises. The growing consumer preference for independent floors since the pandemic shows no signs of relenting, particularly in key markets of Gurugram and Faridabad.

Anuj Puri, Chairman – ANAROCK Group says, “We are seeing a clear shift in homebuyer preferences towards independent floors in key NCR markets like Faridabad and Gurugram. The trend in the key Southern cities of Bengaluru, Hyderabad, and Chennai is towards plotted developments. The supply share of high-rise projects has been on a y-o-y decline since 2019.”

“In the key Western cities of MMR and Pune, we are seeing supply trends shifting towards smaller, lower-rise projects of <100 units. The new demand realities of the Covid-19 pandemic towards low-saturation housing projects aside, both the completion timelines and capital requirements for smaller projects are much lower.”

- NCR spearheads this changing post-Covid-19 trend – of 62 projects launched in the region in 2021, approx. 39 projects (63%) were high-rises, while in 2019, of 61 projects, 58 projects (95%) were high-rises. Housing demand in NCR is shifting towards independent homes. Apart from this changing consumer demand, developers can complete and monetize independent homes projects much faster – in many cases, in as little as a year – while high-rises can take four years or more to pay off

- Predictably, land-starved MMR has seen a much lower change in the total share of the high-rises. Of 421 projects launched in the region in 2021, nearly 263 (62%) projects were high-rises. In 2019, of approx. 360 projects launched, 250 (69%) were high-rises. While apartments continue to dominate new supply, MMR is witnessing a marked increase in the launch of smaller low-rise buildings in 2021. In 2021, MMR saw approx. 56,880 units launched in approx. 421 projects. 2019 saw more units launched – approx. 77,990 units in over 360 projects.

- Pune witnessed a similar trend with more low-rise projects launched; however, the city’s share of high-rises also declined – from 89% in 2019 to 72% in 2021. Of 235 projects launched here in 2021, 170 were high-rises. In 2019, of approx. 185 projects launches, 165 projects were high-rises.

- In the southern cities, the high-rise culture is declining while demand for plotted developments has been on the rise after Covid-19. Many developers have begun focusing on plotted development projects. In the three key South cities Bengaluru, Chennai and Hyderabad, approx. 383 projects were launched in 2021, of which 118 projects (31%) were high rises. In 2019, of approx. 307 projects launched, 109 (36%) were high-rises.

- Of 103 projects launched in Chennai in 2021, a mere 10 projects were high-rises. In Bengaluru, of 140 projects launched last year, 51 projects (36%) were high-risesand in Hyderabad, of 140 projects launched, 57 were high-rises.

- Kolkata saw 77 projects launched in 2021, of which 24 (31%) were high-rises; in 2019, of approx. 47 projects launched, 21 (45%) were high-rises.

Also Read: BMC received ₹13543 Cr till Jan 2022 from Real Estate target earlier was ₹2000 Cr