With the home loan interest rates at its lowest, homebuyers are opting for home loans. But the tenure that most homebuyers are. opting for was revealed in a recent survey.

By Varun Singh

With home loan interest rates at its lowest, around 51% of the home buyers are now preferring to have a borrowing period as follows.

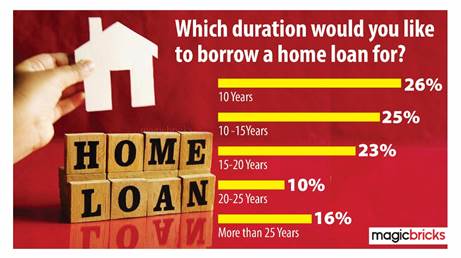

A recent poll comprising of a sample size 500 by Magicbricks suggests that the period of up to 10 years is the most preferred duration of home buyers with 26% of the respondents giving the nod for it.

It was followed by 10-15 years (25%) and 15-20 years (23%) as the next most preferred tenures for home loans.

About 16% respondents said that they would like to take a loan for more than 25 years, while only 10% said that they would wish to take a home loan for 20-25 years.

Homebuyers behaviour on housing loans suggests that most of the demand for home loans is being generated from the key residential markets of Bengaluru, Hyderabad, Delhi, Mumbai, and Pune.

Commenting on the consumer trend, Sudhir Pai, CEO, Magicbricks, said: “We are witnessing a demand revival for home loans for mid and high range homes due to multiple reasons like need for an extra room due to Work From Home (WFH), reduction in circle rates, stamp duty, and low interest rates. With average home loan interest rates hovering between 6.65%-6.90% borrowers are now want to repay their mortgages as fast as possible. Thus, around 50% of the borrowers now prefer to have a loan tenure of up to 10 years or 10-15 years and close their financial liability as quickly as possible.”

Currently, the home loan interest rates for consumers are the lowest, as witnessed over the last one decade or more with experts suggesting that this is the best time to bargain and negotiate for the best real estate deals.

Several public and private banks and other financial institutions have reduced their home loan interest rates, which in turn offers further impetus to the rising consumer appetite in the home buying space.

With the Reserve Bank of India keeping the repo rate unchanged at a constant 4% in its recent policy review meeting, many banks are also offering interest rates less than 7% for home loans to further catalyse the rising demand for home buying.

Meanwhile, Harsh Vardhan Patodia, President, CREDAI had recently issued a statement on Supreme Court refusal to extend loan moratorium.

Patodia had said, “We appreciate the view of Hon’ble Supreme Court for guiding the matter of extension of loan moratorium for a period of six months this year to the Reserve Bank of India. In line with the representation made to the apex court, we feel due relief for borrowers is an absolute necessity considering the prolonged impact of the second wave of the pandemic, and consequent financial stress borne by individuals and businesses due to loss of employment and business opportunities. With the real estate sector being more severely impacted in 2021 as compared to 2020, as the apex industry body, CREDAI has already made separate representations to RBI and the Government of India on the matter.”

Also Read: Repo Rate Unchanged, Home Loans Continue To Remain Attractive