Price is an important factor when one decides to buy a house. While we talk about the Indian real estate market let also look at how much did the price increase in 2021?

By Varun Singh

In an extraordinary year marred by the pandemic and lockdowns, the real estate sector showed great resilience in 2021.

In their latest report, Knight Frank India notes that the Residential Sector had an unprecedented year of growth with sales rising by 51% year on year (YoY) to be recorded at 232,903 units across the top eight cities of the country.

New home launches also saw a significant rise of 58% YoY with the addition of 232,382 units in 2021.

For the Commercial office segment, the year was a mixed bag. Leasing volumes, recorded at 38.1 million square feet (MSF) though remaining at similar levels as 2020, clearly indicated towards the potential the market has in terms of leasing.

Noteworthy is that an overwhelming 68% of the total leasing in 2021 took place in the second half of the year. Bengaluru led the pack with 12 MSF of total leasing during the year. New completions in 2021 for office space was recorded at 39 mn sq ft, higher by 9% over the preceding year.

The report presents a comprehensive analysis of the residential and office market performance across eight major cities for the July-December 2021 (H2 2021) period.

H2 2021 cited that 133,487 housing units were sold in second half of the year 2021 cumulatively for the top eight cities.

This also showcased a substantial 41% increase Year-on-Year (YoY). Around 69,477 housing sales were reported in Q4 2021. Residential prices stayed steady or recorded marginal growth in seven of eight cities during the year. Homes priced over Rs 50 lakhs constituted around 58% of the overall sales in H2 2021.

Mumbai (34,382), National Capital Region (23,599) and Bengaluru (23,218) were the leading residential sales performers in H2 2021. Hyderabad and Bengaluru witnessed the highest home sales (in terms of percentage growth) during H2 2021 at 135% and 104% YoY respectively. In the calendar year 2021, Mumbai (62,989), Bengaluru (38,030) and Pune (37,218) led in terms of sales.

On the office market performance, Knight Frank India cited that the top eight cities recorded transactions of 25.9 mn sq ft in July – December 2021, whereas the office completions were recorded at 23.7 mn sq ft in the same period. Six of the eight markets saw transaction volumes grow in YoY terms during H2 2021. With the increasing need for flexibility and a hybrid working environment, co-working/ managed office sector’s transactions share increased to 18% in H2 2021 from 10% in H2 2020. With 8.7 mn sq ft transactions in H2 2021, Bengaluru recorded its highest ever office leasing activity in a half yearly period.

From the perspective of half-yearly sales, H2 2021 posted the highest sales volume since H1 2016. Low interest rates, improving affordability, and a resurging interest in home ownership due to the space constraints imposed by the pandemic, have been the primary drivers of this revival in demand. Developers strategically responded to this seismic shift in sentiment and launched almost 0.13 mn units in H2 2021, 50% higher than H2 2020. The incidence of direct discounts had reduced substantially during H2 2021.

Mumbai, National Capital Region and Bengaluru dominated the home sales activity in the country.

Despite the stamp duty cut window closure in March 2021, Mumbai and Pune accounted for 41% of the home sales during H2 2021. Homebuyers in the Information Technology sector dominated markets were relatively less impacted by pandemic induced disruptions and were well poised to take the plunge in H2 2021. This has primary been the reason for positioning Hyderabad and Bengaluru as the leading sales growth markets (in percentage terms) in the country in H2 2021.

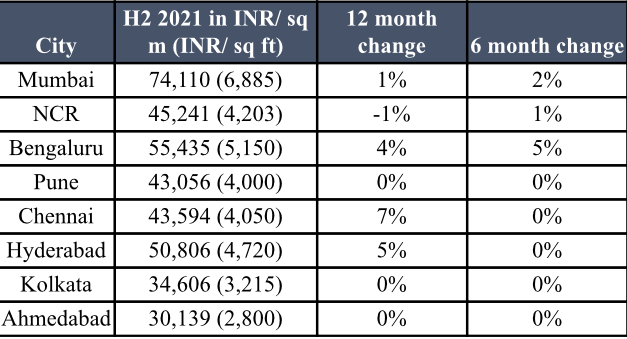

In terms of 12-month residential price change, Chennai, Hyderabad and Bengaluru registered increment of 7%, 5% and 4% respectively. Mumbai witnessed a marginal increment of 1%. The prices were recorded to be stable in Pune, Kolkata and Ahmedabad. National Capital Region marked a marginal decline of 1%. However, price levels in seven of the eight markets under review were observed to remain at the same level or record marginal growth in the 6-month period.

The share of sales of INR 10 mn category has grown from 21% to 23% in the same reference period.

Shishir Baijal, Chairman and Managing Director, Knight Frank India said, “Despite the disruptions caused by the pandemic, residential sales momentum increased across the key eight markets of the country due to a plethora of demand stimulants such as lowest home loan rates, government sops and change in attitude. Sentiments remain strong and should continue to aid market volumes in the near term. While buyer preferences were skewed towards ready inventory, established developers with a robust execution record are increasingly finding a market for their under-construction inventory.”

Also Read: Bhushan Kumar Of T-Series Paid Rs 167 Crore For Juhu Bungalow