Unsold housing inventory in MMR overhang is back nearly at 2015 levels (42 months) amid rising sales, says a report.

By Varun Singh

On examining the overall performance of the residential segment across the top cities in the last one year, it emerges that MMR was indisputably the best performer.

At the end of Q2 2021, MMR’s unsold housing inventory overhang reduced to 43 months from the peak of 55 months in 2020 amid Covid-19. (The areas considered under MMR include Mumbai, Navi Mumbai and Thane).

This drop of 12 months’ inventory overhang is the biggest among all top 7 cities. Currently, MMR’s unsold inventory overhang is close to being back to the level last seen in 2015, when it was 42 months. In contrast to the other top cities, MMR saw the maximum yearly decline of 6% in its overall unsold stock – from approx. 2.10 lakh units as on Q2 2020 to approx. 1.97 lakh units as on Q2 2021.

“Until just a few years ago, the property market in many areas of MMR was more or less defined by unaffordability,” says Anuj Puri, Chairman – ANAROCK Property Consultants. “In that respect, the pandemic was a gamechanger for the region. Stamp duty cuts, extremely low home loan interest rates, and developer discounts and offers boosted MMR’s housing market in one of the most challenging and difficult years in remembered history.”

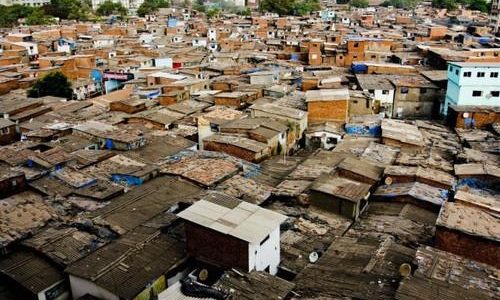

A reduction in the overall cost of acquisition bottomed out in one of the most expensive regions in India is remarkable. Property prices in Mumbai had increased by as much as 7-10 times over the past 20 years. The average number of monthly incomes required to own a home in this city is the highest among major Indian cities at between 67-90 times of an average monthly income.

Until the pandemic unfolded, less than 5% of the people living in Mumbai could afford to buy a home here, either outright or with a home loan.