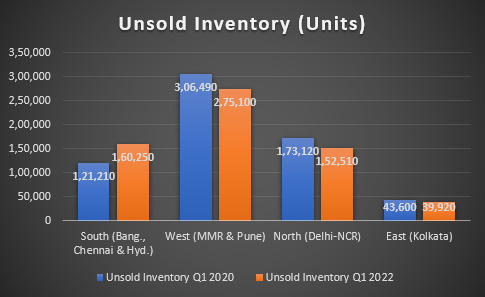

- NCR unsold inventory declined from approx. 1.73 lakh units by Q1 2020-end to approx. 1.53 lakh units by Q1 2022-end

- South cities Bengaluru, Hyderabad & Chennai saw their collective unsold stock increase by 32% in the same period, MMR & Pune in West saw a collective decline of 10%

- NCR also saw the sharpest decline in unsold inventory between Q1 2020 and Q1 2022

Before Covid-19, NCR’s residential market activity lagged far behind its Southern counterparts as it grappled with delayed project deliveries due to the financial crisis and disruptive policy interventions like DeMo, RERA, and GST. The post-Covid period saw a notable shift, with Delhi-NCR outpacing its southern and western counterparts.

Latest ANAROCK data shows that NCR’s unsold inventory declined by 12% in Q1 2022 against pre-pandemic Q1 2020, while the main Southern cities Bengaluru, Hyderabad, and Chennai saw their collective unsold stock increase by 32% in this period. MMR and Pune in the West saw their cumulative unsold stock reduce by 10%.

As Santhosh Kumar, Vice Chairman – ANAROCK Group, points out – “NCR’s unsold stock declined from approx. 1.73 lakh units in Q1 2020-end to approx. 1.53 lakh units by Q1 2022-end. In the same period, the main southern cities saw their unsold stock increase from approx. 1.21 lakh units in Q1 2020 to over 1.60 lakh units in Q1 2022. However, it bears highlighting that this rise in unsold inventory was primarily because of a massive new launch rate in Hyderabad.

Interestingly, this is the first time that in a quarter, NCR’s total unsold stock clocked in lower than in South India’s collective unsold stock. In the West’s MMR and Pune, the unsold stock declined by 10% between the pre and post-pandemic periods – from approx. 3.07 lakh units by Q1 2020 to approx. 2.75 lakh units in Q1 2022.

NCR also outstripped both the Southern and Western markets in supply additions with a massive 204% rise in new launches in Q1 2022 compared to Q1 2020 – from 6,190 units in Q1 2020 to approx. 18,840 units in Q1 2022.

“We attribute NCR’s significantly upbeat performance to returning consumer confidence, prompted by the fact that several leading and listed players have amplified their supply pipeline in the region,” says Santhosh Kumar. “With a 204% increase of new homes between Q1 2020 and Q1 2022, NCR has resoundingly broken its previous trend of restricted new supply. Remarkably, despite this massive new supply, the region’s unsold stock saw the steepest reduction among all other regions.”

Collectively, the Southern cities saw approx. 37,810 new homes launched in Q1 2022 – a 142% increase against the 15,650 units in Q1 2020, while the Western cities witnessed a 109% jump – from 18,270 units in Q1 2020 to approx. 38,130 units in Q1 2022.

| New Launches (Units) Region-wise | |||

| Region | Q1 2020 | Q1 2021 | Q1 2022 |

| South | 15,650 | 24,930 | 37,810 |

| West | 18,270 | 28,640 | 38,130 |

| North | 6,190 | 6,750 | 18,840 |

| East | 1,090 | 1,810 | 5,990 |

Data Breakdown – NCR’s Primary Cities

- Of the total unsold inventory in NCR, Gurugram currently has the maximum stock with approx. 63,870 units – an increase of 6% over pre-pandemic period Q1 2020. The rise is largely because of newly-added supply

- Greater Noida comes next with approx. 31,240 unsold units by Q1 2022-end; unlike Gurgaon, Greater Noidareduced its unsold stock by 24% since Q1 2020

- Ghaziabad saw its unsold stock decline to 18,900 units in Q1 2022 from 27,140 units in Q1 2020 – a massive 30% yearly reduction

- Noida has approx. 13,800 unsold units as on Q1 2022-end, against 18,150 units in Q1 2020 – a decline of 24%

- Delhi, Faridabad and Bhiwadi together have over 24,700 unsold units as on Q1 2022-end from 24,790 units by Q1 2020-end – a minimal change

| Available Inventory in Delhi-NCR (Units) | |||

| Q1 2020 | Q1 2022 | % Change | |

| Gurugram | 60,130 | 63,870 | 6% |

| Noida | 18,150 | 13,800 | -24% |

| Greater Noida | 42,900 | 31,240 | -27% |

| Ghaziabad | 27,140 | 18,900 | -30% |

| Faridabad, Delhi, Bhiwadi | 24,790 | 24,700 | 0% |

| Total | 1,73,110 | 1,52,510 | -12% |

Also Read: REIT vs Physical Real Estate: Which One is the better investment option?