The National Housing Bank (NHB) has released its latest report on the Trends and Progress of Housing in India, 2024, highlighting significant growth in the housing sector driven by changing buyer preferences, government initiatives, and increasing credit flow.

Key Findings of the Report

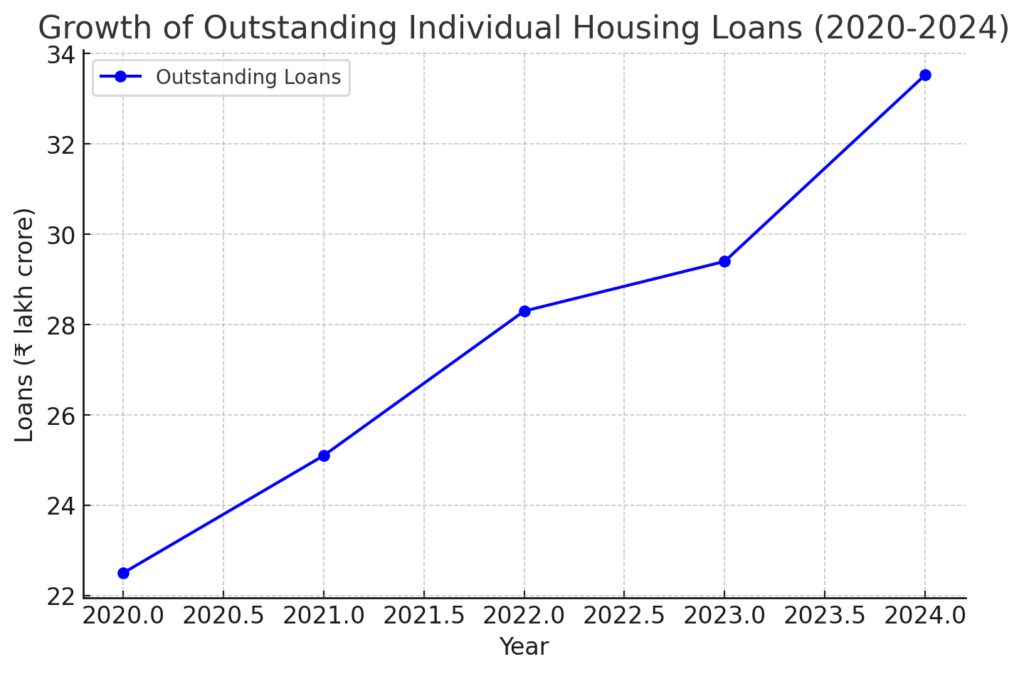

According to NHB, as of September 30, 2024, the total outstanding individual housing loans in India reached ₹33.53 lakh crore, marking a 14% year-on-year (YoY) increase. The report attributes this rise to growing urbanization, policy support, and an expanding mortgage market.

- Loan Disbursements: During the half-year ending September 30, 2024, ₹4.10 lakh crore in housing loans were disbursed, contributing to a total of ₹9.07 lakh crore disbursed in the financial year 2023-24.

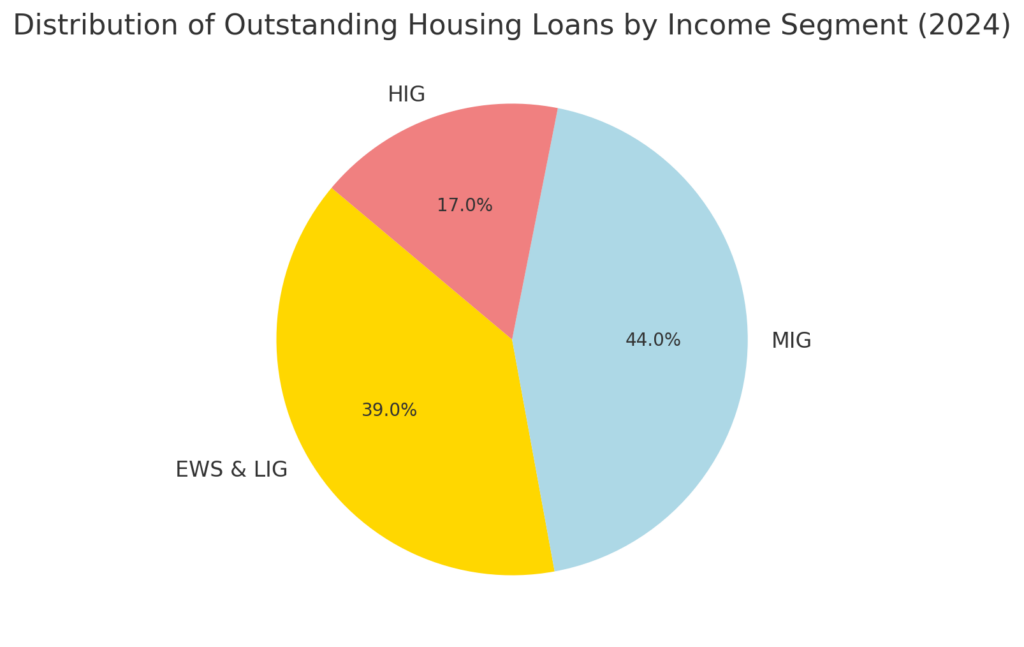

- Segment-wise Loan Distribution: Affordable housing dominated, with the Economically Weaker Section (EWS) and Low-Income Group (LIG) segments accounting for 39% of outstanding housing loans. The Middle-Income Group (MIG) comprised 44%, while the High-Income Group (HIG) made up 17%.

- Housing Price Index (HPI) Trends: The NHB-RESIDEX index recorded a 6.8% YoY increase in housing prices as of September 2024, compared to a 4.9% rise in the previous year.

Government Initiatives Driving Growth

The NHB report highlights the impact of major government schemes such as the Pradhan Mantri Awas Yojana (PMAY-U and PMAY-G), the Affordable Rental Housing Complexes (ARHC) scheme, and the Urban Infrastructure Development Fund (UIDF). The anticipated rollout of PMAY 2.0 and the increased focus on transit-oriented development are expected to sustain sectoral growth.

Challenges and Future Prospects

While the housing sector has witnessed robust expansion, the report underscores challenges such as regional disparities in credit access, affordability concerns, and climate-related risks. However, advancements in construction technology, digitization of land records, and policy support provide promising avenues for continued growth.

SFI Analysis:

The NHB report reaffirms the strength of India’s housing sector as a key driver of economic growth. The 14% YoY surge in individual housing loans indicates a resilient demand for homeownership, supported by affordable financing options and government incentives. The dominance of the MIG and affordable housing segments underscores the growing aspirations of India’s middle class. Additionally, the 6.8% rise in housing prices suggests sustained investor interest and confidence in real estate. However, ensuring equitable credit access across regions and mitigating economic uncertainties remain critical for long-term stability. Moving forward, integrating technology-driven solutions and sustainable housing practices will be pivotal in shaping India’s housing market trajectory.