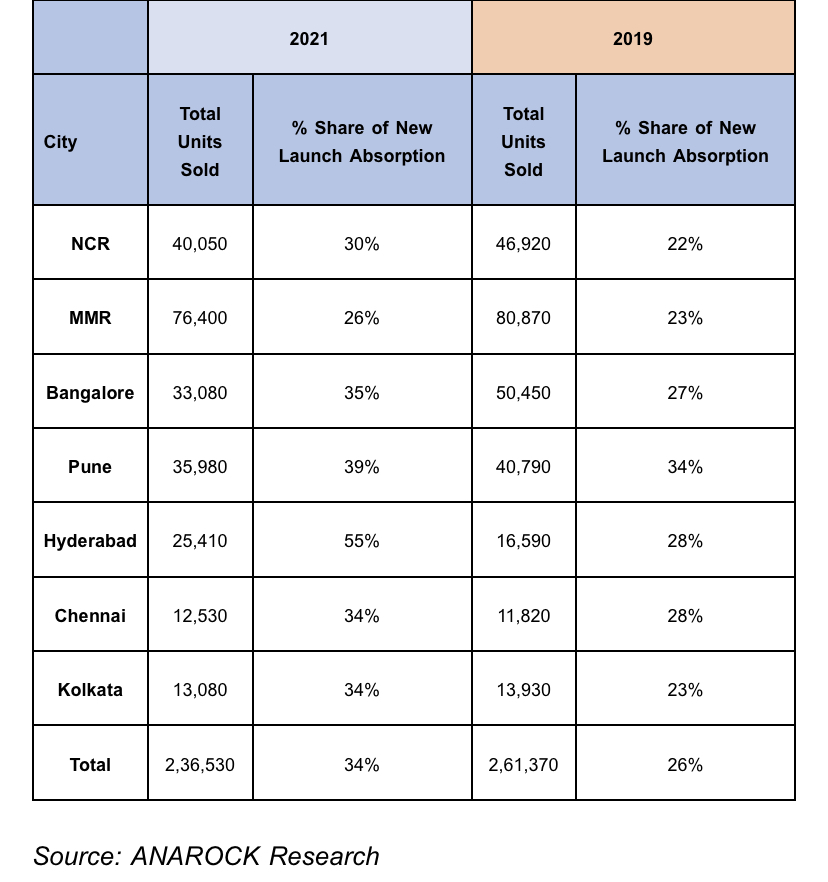

MMR had the lowest share at 26% of the total 76,400 units sold in 2021. Of 2.37 lakh units sold across the top 7 cities in 2021, over 34% were newly launched; in 2019, of approx. 2.61 lakh units sold, 26% were newly launched

By Varun Singh

Newly-launched homes are back in demand after a prolonged period wherein the demand spotlight shone mainly on ready-to-move-in units. While end-users continue to drive the housing market and ready or soon-to-be-completed homes are still in the highest demand, new launches are finding takers again. Latest ANAROCK Research data shows that out of the total 2.37 lakh homes sold in 2021 across the top 7 cities, over 34% were newly-launched units.

In 2019, the sales share of newly-launched homes was lower. Of approx. 2.61 lakh homes sold in 2019, newly-launched homes accounted for approx. 26%. In 2020, of 1.38 lakh units sold in the top 7 cities, 28% were launched during the year.

Hyderabad accounted for the maximum absorption share of new units among the top 7 cities. Of 25,410 units sold in 2021 in the city, approx. 55% were launched in the same year. MMR saw the lowest absorption of newly-launched homes – of 76,400 units sold in 2021, just 26% were launched during the year. The remaining were old projects launched before 2021.

Anuj Puri, Chairman – ANAROCK Group, says, “End-users with a preference for ready-to-move-in or almost-complete homes continue to rule the roost. However, the demand scale is shifting gradually. Among other things, the increased sales share of newly-launched homes heralds the revival of investor interest. This is significant – over the last 3-4 years, investors had more or less exited the residential real estate stage and were focusing on other asset classes.”

“Also, well-capitalized branded developers with a reputation to protect have been ramping up their market share of new launches. Buyers are confident of such players’ ability to complete their projects on time. In 2021, of 2.37 lakh new units launched in the top 7 cities, the share ratio of branded vs non-branded developers was 58:42; in 2015, the ratio was 41:59.”

In any case, this trend bears watching. While the return of investors is positive from a sales point of view, an end-user driven market helps keep prices in check. As evidenced in the past, increasing investor activity can lead to faster price hikes.

City-wise Absorption Trends

The top two markets of MMR and NCR saw the lowest absorption share of newly-launched units at 26% and 30%, respectively. If we compare it to 2019, this share has risen in both cities in 2021 but continues to be lower than in other cities.

Essentially, buyers in NCR and MMR are cautious and opt for either ready or nearing completion homes, despite the higher prices. As per ANAROCK Research, NCR and MMR together comprise a massive 76% share of 6.29 lakh delayed/stalled units across the top 7 cities. These units were launched either in 2014 or before.

- In MMR, of 76,400 units sold in 2021, approx. 26% were newly-launched. In 2019, of 80,870 units sold, 23% were newly-launched

- In NCR, of 40,050 units sold in 2021, approx. 30% were launched in the same year. In 2019, of 46,920 units sold, the sales share of newly-launched units was 22%. Evidently, homebuyer confidence in this once highly troubled market is on the rise

- In Chennai, of 12,530 units sold in 2021, newly-launched units accounted for a 34% share – up from 28% of 11,820 units sold in 2019

- In Kolkata, of 13,080 units sold in 2021, 34% were newly-launched. In 2019, approx. 13,930 units were sold, of which 23% sales were of newly-launched units

- In Bengaluru, of 33,080 units sold in 2021, the sale share of newly-launched units was 35% – up from 27% of 50,450 units in 2019

- In Pune, of 35,980 units sold in 2021, the sale share of newly-launched units was 39% – up from 34% of 40,790 units in 2019

- Hyderabad comprised the maximum sales share of newly-launched units among the top 7 cities. Of approx. 25,410 units sold in 2021, 55% were launched in the same year – significantly up from 28% of approx. 16,590 units in 2019

Also Read: Nawab Malik’s son Buys Rs 9.95 Crore Flat in Bandra says flooding in Kurla reason for Shift