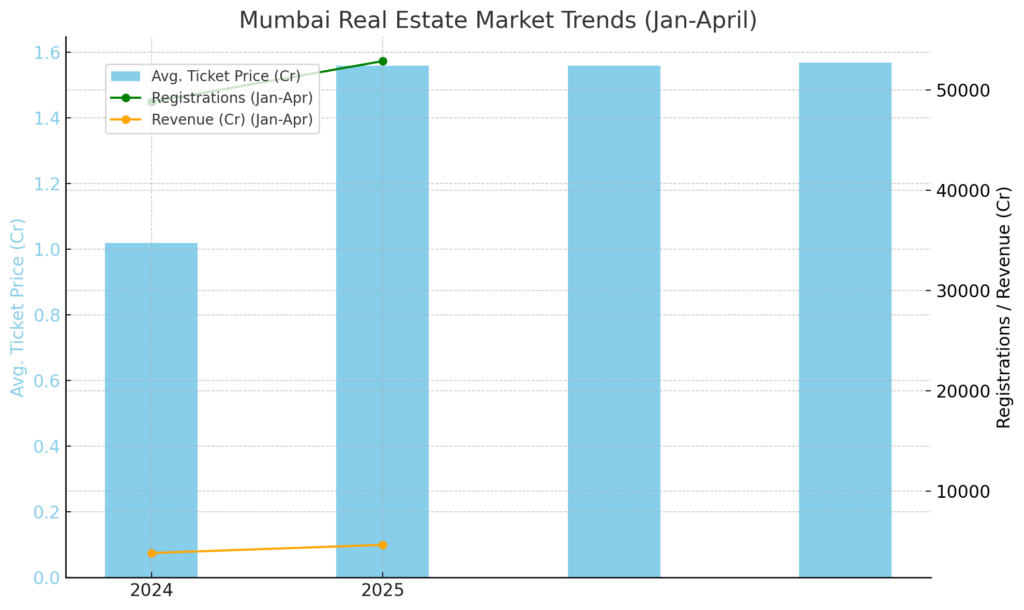

April 2025 also logs highest registrations in seven years; premium housing sales drive surge

Mumbai’s property market has shattered previous records in the first four months of 2025, with 52,896 properties registered between January and April — an 8% increase from the 48,819 registrations recorded during the same period last year, according to data from the Maharashtra State Revenue Department.

The revenue collected through stamp duty and registration fees during this period soared to approximately ₹4,633 crore, reflecting a 21% rise compared to ₹3,826 crore collected in Jan–April 2024.

This record-breaking trend comes despite economic headwinds, global uncertainty, and a noticeable decline in overall housing sales across the Mumbai Metropolitan Region (MMR) in Q1 2025.

April 2025 Sets New Benchmark

April alone saw 13,080 property registrations in Mumbai — the highest for this month in the past seven years — surpassing last April’s 11,648 registrations by 12%. The state earned ₹1,115 crore in revenue from registrations in April 2025, up from ₹1,057 crore during the same month in 2024.

Real estate analysts attribute this strong April performance to the festive push during Akshaya Tritiya, considered an auspicious time for purchases, and the spillover effect of heavy activity in March.

March Spike Boosts Q1 Recovery

March 2025 was particularly noteworthy, with 15,501 property registrations generating ₹1,589 crore in revenue — the highest monthly figure in three years. The spike followed the announcement of a 3.9% increase in Maharashtra’s ready reckoner rates for FY2025–26.

This strong finish helped the market bounce back from February’s slowdown (12,066 registrations and ₹935 crore in revenue), and surpassed even previous highs recorded during stamp duty reductions in the COVID era.

High-Value Homes Drive Growth

The average ticket size of homes sold from January to April 2025 stood at ₹1.57 crore, consistent with ₹1.56 crore seen in 2023 and 2024. In March 2025, the average price spiked to ₹1.86 crore, pointing to increased sales in the premium segment.

By contrast, in the same period in 2021, the average property price was ₹1.02 crore — marking a 54% increase over four years.

“2025 is showing sustained momentum in high-ticket home sales,” said Anuj Puri, Chairman of ANAROCK Group. “March saw a sharp surge due to the impending rate hike, but overall, the first four months reflect strong buyer confidence in Mumbai’s residential market.”

Conclusion

Despite macroeconomic challenges and softening in some segments, Mumbai’s real estate market has shown resilience and appetite for premium properties. With registration volumes and revenue hitting new highs, stakeholders are optimistic that this momentum will continue through the year.