Peripheries not city, will see a rise in home buying activities in the coming days. The reason being Work from Home gaining momentum and Walk to Work losing its sheen.

By Varun Singh

When it comes to buying a home, the concept till now has been homebuyers prefer projects that are close to the city centre.

However, the pandemic, followed by the lockdown which made Work for Home a reality in Metro cities has changed the dynamics.

Even in real estate all of a sudden there appears a scenario where homebuyers would go for peripheries rather than city limits. Even developers are changing with time and demand.

The reason is simple, Work from Home would mean less travel, thus Walk to Work will not be much adopted.

Take example of the pricing, which will also be a major factor for people opting for peripheries over city.

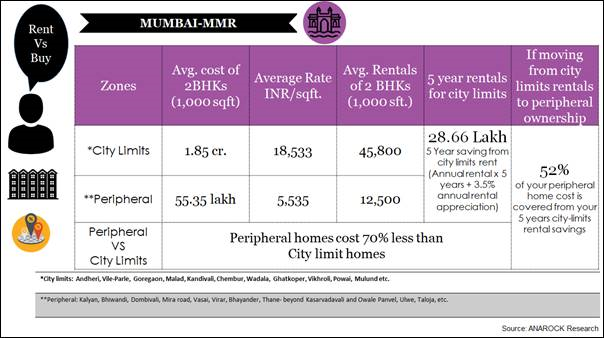

According to Anarock Property Consultants, in Mumbai Metropolitan Region, average price of standard 1,000 sq. ft. home is 70% higher in city limits than in peripheral areas.

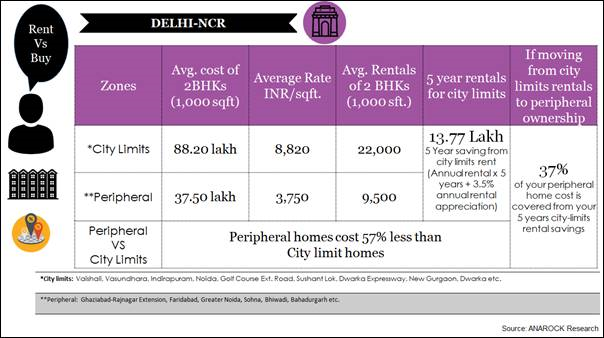

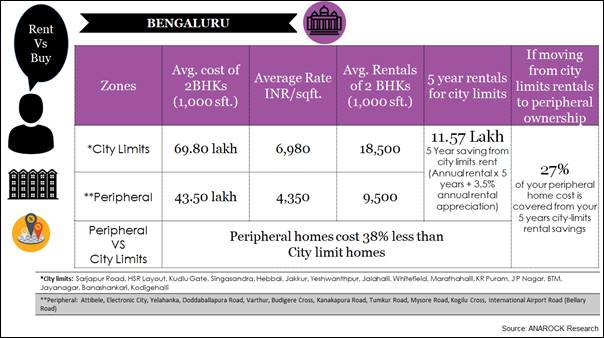

The same in NCR is 57%, and in the difference between peripheries and city limits in Bengaluru is 38%.

In MMR, the average price for a standard 1,000 sq. ft. property in areas within city limits is approximately Rs 1.85 crore, against Rs 55.35 lakh in the peripheral areas – a 70% cost difference.

In NCR, the average price for a standard 1,000 sq. ft. property in areas within city limits is approximately Rs 88.20 lakh, against Rs 37.50 lakh in the peripheral areas – a 57% cost difference.

In Bengaluru, the average price for a standard 1,000 sq. ft. property in areas within city limits is approximately Rs 69.80 lakh, against Rs 43.50 lakh in the peripheral areas – a 38% cost difference.

Even when one compared the rentals of city limits, a deep analysis shows that, buying a home in peripheries would be a preferable idea,

In MMR, the average monthly rental outgo in city-limit areas is Rs 45,800. For five years, this equals nearly Rs 28.66 lakh (including standard rental escalation for this period). This is almost 52% of the total average cost of a property in MMR’s peripheral areas.

In NCR, the average monthly rental outgo in city-limit areas is Rs 22,000. For five years, this equals nearly Rs 13.77 lakh (including standard rental escalation for this period). This is almost 37% of the total average cost of a property in NCR’s peripheral areas.

In Bengaluru, the average monthly rental outgo in city-limit areas is Rs 18,500. For five years, this equals nearly Rs 11.57 lakh (including standard rental escalation for this period). This is almost 27% of the total average cost of a property in the peripheral areas.

“The work-from-home concept may become the next fulcrum for homebuying decisions, where the walk-to-work option had held the longest sway,” says Anuj Puri, Chairman – ANAROCK Property Consultants.

Puri further added, “With the rise of the WFH culture, many may now prefer to live in more spacious and cost-effective homes in less central areas. While sufficient supply currently exists in most of the peripheries, this new demand will eventually also dictate fresh supply. Bigger homes, affordable prices and more generous open spaces in the peripheral areas will draw demand from tenants and buyers alike.”

To add to this, the current home loan interest rates are at an all-time low, averaging around 7.15-7.8% – with the possibility of more reduction as the RBI recently cut repo rates even further.

Even developers agree that the shift will happen towards peripheries and have started working on those lines. According to Arvind Goel a developer from Navi Mumbai, the half bedroom that he use to offer in 1.5 and 2.5 BHK will now be planned as office space.

“Peripheries will see a rise in demand, but those projects which have a proper infrastructure not some stand alone building in a corner. The half bedroom if converted in to an office shall be the Work for home,” said Goel. Not just officer goers, but even small business can operate form this half bedroom, that can be used as an office.

Meanwhile, developers also want government to help the real estate industry, for a very long time there has been this demand from various indsutrialists and even ministers that developers should reduce price.

Goel, who also is associated with CREDAI-MCHI says, that time has come government acts, because unless they don’t amend the Income Tax Act, and reduce ready reckoner rates, builders won’t be able to lower the prices. One of the major demand is that of lowering stamp duty.