- Office sector drew highest PE at 38%, Industrial & Logistics sector 22%, Residential just 14%

- Investments by domestic funds doubled in size in FY22 – from USD 290 Mn (FY21) to USD 600 Mn (FY22

- Sans portfolio deals, average ticket size reduced to USD 93 Mn

By Varun Singh

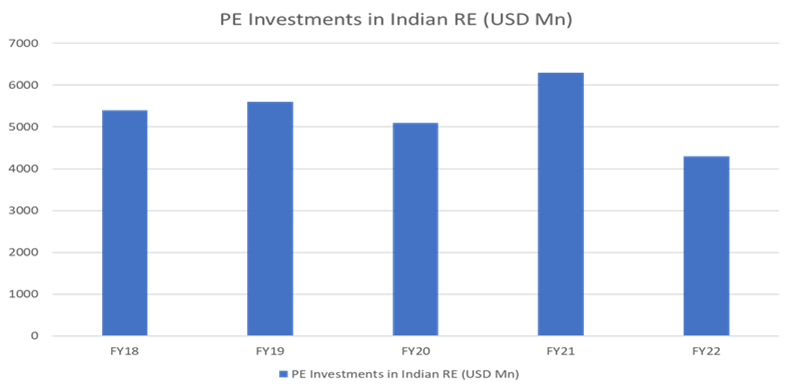

Real estate private equity (PE) investments registered a decline of 32% in FY22 as compared to FY21, finds ANAROCK Capital’s FY22 year-end edition of its FLUX report. At least partially to blame for this was the destructive effect of the 2nd wave of COVID-19, which led to multiple lockdowns in various parts of the country, and serious economic disruptions in almost all industries.

FY22 also saw a huge drop of 42% in average deal ticket size, though it is still higher than FY18 levels. The drop in ticket sizes is largely due to investors’ focus shifting back to individual assets, as opposed to their preference for portfolio deals in FY21.

Unlike in FY21, investors in FY22 preferred single city deals over multi-city deals, resulting in the share of multi-city deals reducing by nearly 70% in FY22.

Shobhit Agarwal, MD & CEO – ANAROCK Capital, says, “Equity continues to remain around 80% of the total PE investments in Indian real estate. The commercial sector attracted the highest investment in FY22 (38%), followed by the Industrial & Logistics sector (22%), with Residential clocking in at a mere 14%. Meanwhile, investments by domestic funds doubled in size in FY22 – from USD 290 Mn (FY21) to USD 600 Mn (FY22). The increasing confidence of domestic funds reflects the return of overall positivity after a harrowing year of pandemic disruption and uncertainty.”

Key Takeaways:

- The residential real estate sector continued to witness steady tailwinds of accelerated consumer demand for homeownership, coinciding with near historically low mortgage rates

- Industrial & Logistics became the 2nd most preferred asset class after commercial office; this trend is expected to grow considerably in the coming years

- Deal activity focus shifted back to individual assets from portfolio deals in FY22

- The absence of portfolio deals resulted in average ticket size reducing to USD 93 Mn – back to FY19 levels, yet still higher than FY18 levels

- Multiple deals slipped into the next financial year due to transactional delays

- Domestic PE investors showcased higher confidence – their contribution increased from 5% in FY21 to 14% in FY22, also remaining higher than FY18 levels

- The listed REIT market regained sizable market cap in the last 12 months

- PE investor interest in Grade A office assets with quality tenants remain high; more ownerships are expected change hands in the coming years

- Data centres as an asset class is an exciting emerging sector

- Last-mile funding led by SWAMIH Fund remained healthy

Also Read: Celeb Realty